Investment banks face a critical infrastructure decision: build custom AI agent integrations for substantial annual costs, or deploy purpose-built MCP gateways that deliver enterprise-grade security and governance from day one. Model Context Protocol (MCP) has emerged as the backbone of AI-native enterprises, supported by Anthropic, OpenAI, Google, and Microsoft—but choosing the right gateway determines whether your AI agents operate as compliant, auditable tools or ungoverned security risks.

According to NIST cybersecurity guidelines, financial institutions must implement comprehensive access controls, continuous monitoring, and audit capabilities for all technology systems—areas that MCP gateways can help operationalize for AI agent infrastructure (access control, monitoring, audit logs). Banks using standardized MCP integrations reduce development time significantly compared to custom API integrations, while maintaining the regulatory compliance that financial services demand.

This guide evaluates eight leading MCP gateway solutions for investment banking, ranked by compliance capabilities, performance benchmarks, security architecture, and financial services integration. Each gateway addresses different priorities—from regulatory compliance to high-frequency trading performance—ensuring you find the right fit for your institution's requirements.

Key Takeaways

- Compliance certification matters: MintMCP is SOC 2 Type II compliant, making it a strong choice for banks facing strict regulatory requirements.

- Performance benchmarks vary significantly: TrueFoundry achieves 3-4ms latency, critical for trading systems requiring real-time responsiveness.

- Cost savings are substantial: Banks using standardized MCP gateways reduce development time by 60-80% compared to custom API integrations.

- Security-first options exist: Lasso Security offers real-time prompt injection detection for banks prioritizing AI-specific threat prevention.

- Integration breadth accelerates deployment: Composio provides 500+ pre-built connections, reducing time-to-production for multi-system implementations.

1. MintMCP Gateway – Compliance-First Enterprise Platform

MintMCP Gateway stands as a SOC 2 Type II compliant MCP platform, purpose-built for regulated industries where audit trails and enterprise authentication aren't optional—they're mandatory.

What Sets MintMCP Apart

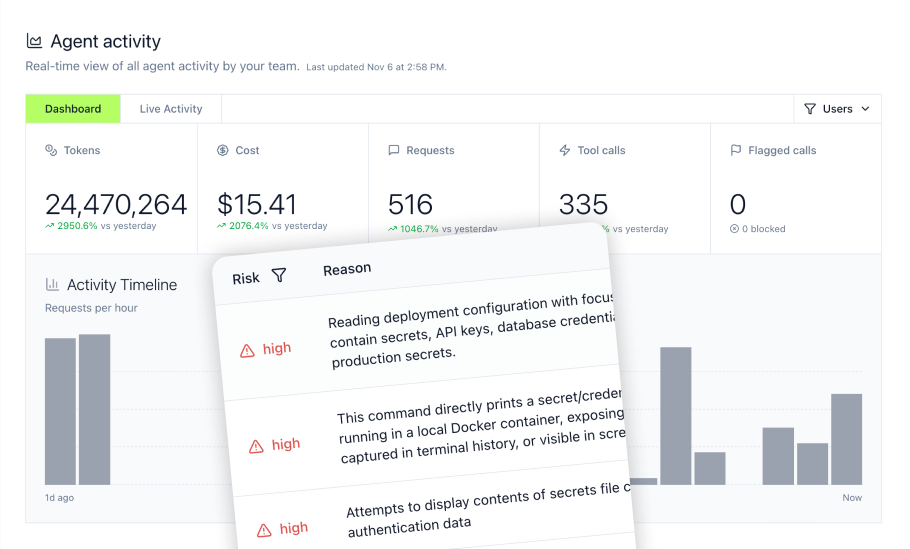

MintMCP transforms local MCP servers into production-ready services with one-click deployment, automatic OAuth wrapping, and comprehensive audit trails for every interaction. The platform provides complete visibility into AI tool usage—tracking every tool call, file access, and command execution—while enabling granular role-based access control.

Core Capabilities

- SOC 2 Type II compliance to support strict security and audit expectations

- OAuth 2.0, SAML, and SSO integration for enterprise authentication

- Real-time monitoring dashboards for usage patterns and security alerts

- Complete audit logs to support SEC/FINRA auditability expectations and GDPR-aligned governance programs

- One-click STDIO server deployment with automatic hosting

- Snowflake and Elasticsearch connectors for financial data integration

Investment Banking Applications

Financial reporting automation: AI agents access Snowflake data warehouses for real-time variance analysis and forecasting with full audit trails.

Compliance documentation: Complete audit trails demonstrate regulatory adherence during examinations, supporting enterprise MCP deployment requirements.

Customer service enhancement: AI assistants retrieve CRM data and support history with full security oversight and authentication.

Why Investment Banks Choose MintMCP

Banks using standardized MCP integrations through MintMCP reduce development time significantly compared to building custom connections. The platform's compliance-first architecture means security and governance are built in—not bolted on after deployment.

Best For: Banks requiring regulatory compliance certification and comprehensive audit capabilities

Deployment: Managed cloud, with additional deployment options available depending on enterprise requirements

2. TrueFoundry

TrueFoundry delivers fast MCP performance—critical for investment banks where latency can matter for real-time analytics and trading-adjacent workflows and real-time analytics.

Performance Specifications

TrueFoundry reports sub-10ms gateway latency in production-oriented benchmarks while handling 350+ requests per second on a single vCPU. The platform scales horizontally, supporting millions of daily agent requests for high-throughput deployments typical in trading environments.

Technical Highlights

- Sub-4ms latency for real-time financial applications

- 350+ requests per second per vCPU with horizontal scaling

- Unified AI infrastructure combining LLM serving and MCP tool orchestration

- Built-in observability with distributed tracing

- Production-ready with enterprise SLAs

Trading System Integration

For banks running algorithmic trading or real-time risk analysis, TrueFoundry's performance profile ensures AI agents operate efficiently. The unified platform consolidates LLM serving and MCP management, reducing infrastructure complexity.

Best For: High-frequency trading systems, real-time analytics, performance-critical AI workflows

Deployment: Cloud and self-hosted options available

3. Lasso Security

Lasso Security addresses MCP's security challenges through an open-source, security-focused gateway that protects against AI-specific attack vectors, as described in enterprise AI infrastructure research.

Security Architecture

Lasso's plugin-based architecture provides real-time threat detection, tool authorization with parameter validation, and network filtering for MCP destinations. The platform specifically protects against credential theft, tool poisoning, and unauthorized data access.

Threat Prevention Features

- Real-time prompt injection detection and blocking

- Tool authorization with parameter-level validation

- Network filtering and allowlisting for MCP destinations

- Comprehensive audit trails for all security events

- Open-source architecture for security transparency

Financial Services Application

Investment banks face unique AI security challenges—from protecting proprietary trading algorithms to preventing unauthorized access to client data. Lasso's security-first approach complements broader compliance frameworks.

Best For: Security-conscious banks with dedicated security engineering teams

Deployment: Self-hosted (open-source)

4. Lunar.dev MCPX

Lunar.dev MCPX bridges the gap between development velocity and production governance—taking MCP from local development to governed deployments without sacrificing developer experience.

Governance Capabilities

MCPX provides centralized RBAC and policy enforcement across all MCP interactions. The platform offers full observability including latency tracking, token/cost monitoring, and request tracing, integrating with enterprise identity and monitoring systems.

Platform Features

- Centralized role-based access control (RBAC)

- Policy enforcement across MCP connections

- Full observability (latency, token usage, cost analytics)

- Support for both STDIO and remote HTTP/SSE MCP servers

- Docker/Kubernetes deployment with optional SaaS dashboards

DevOps Integration

For banks with mature DevOps cultures, MCPX maintains the agility developers expect while adding the governance layers compliance requires. The platform's flexibility in deployment options accommodates varied infrastructure preferences.

Best For: Banks with strong DevOps culture balancing developer velocity with governance requirements

Deployment: Docker/Kubernetes or managed SaaS

5. Docker MCP Gateway

Docker MCP Gateway leverages existing container expertise and infrastructure—enabling banks with mature Docker deployments to add MCP capabilities without architectural disruption.

Container Integration

Docker's MCP solution provides container isolation for MCP server deployments, Docker Compose integration for orchestration, and standard container security practices. Teams already managing containerized workloads apply familiar patterns to AI agent infrastructure.

Infrastructure Benefits

- Container isolation for security and resource management

- Docker Compose orchestration for scaling

- Standard container security and image management

- Familiar deployment patterns for DevOps teams

- Integration with existing container registries and CI/CD pipelines

Enterprise Considerations

Docker's approach works well for banks already invested in container infrastructure. The platform extends existing DevOps investments rather than introducing new operational paradigms.

Best For: Banks with mature container infrastructure seeking infrastructure consistency

Deployment: Container-native (Docker/Kubernetes)

6. Traefik Hub

Traefik Hub extends proven API gateway technology to MCP workflows, implementing a Triple Gate Pattern that provides defense-in-depth across AI, MCP, and API layers.

Security Architecture

Traefik's approach layers security across three gates: AI gateway controls, MCP-specific governance, and traditional API security. The platform supports OAuth 2.0 authentication and Task-Based Access Control (TBAC) for dynamic authorization.

Technical Features

- Triple-gate security architecture (AI, MCP, API layers)

- OAuth 2.0 with On-Behalf-Of authentication

- Task-Based Access Control for dynamic permissions

- Cloud-native design leveraging existing Traefik infrastructure

- Unified gateway for traditional APIs and MCP connections

Integration Advantage

Banks already using Traefik for API management can extend their existing infrastructure rather than deploying separate MCP governance. This reduces operational complexity and leverages existing security configurations.

Best For: Banks with established Traefik API gateway deployments

Deployment: Cloud-native with existing Traefik infrastructure

7. Microsoft Azure MCP Solutions

Microsoft Azure offers dual MCP gateway options—an open-source AKS-based gateway and managed Azure API Management integration—for banks standardized on Azure infrastructure.

Azure Ecosystem Integration

Azure MCP solutions provide seamless Azure integration, Azure Monitor and App Insights observability, and native authentication through Azure AD/Entra ID. Banks already invested in Microsoft's enterprise ecosystem can extend their existing infrastructure.

Platform Options

- Open-source Kubernetes gateway for AKS deployments

- Managed Azure API Management for enterprise licensing

- Native Azure AD/Entra ID authentication

- Azure Monitor integration for comprehensive observability

- Microsoft compliance framework integration

Financial Services Alignment

Many investment banks already use Azure for core infrastructure. Azure MCP solutions extend this foundation to AI agent governance without introducing new vendor relationships or security review processes.

Best For: Banks standardized on Azure infrastructure seeking platform consistency

Deployment: Azure cloud-native

8. Composio

Composio accelerates AI agent development with 500+ pre-built integrations—reducing the integration work that typically consumes months of development time.

Integration Library

Composio operates as an aggregator, providing a single, unified endpoint to a vast library of managed integrations. The platform includes unified OAuth and RBAC out of the box, eliminating the need to build authentication and security for each connection.

Platform Capabilities

- 500+ pre-built, managed tool integrations

- Single unified endpoint for all connections

- Built-in OAuth, RBAC, and PII redaction

- Combined MCP gateway and integration platform

- Accelerated development without DIY integration work

Financial Services Use Cases

Investment banks requiring connections to diverse financial systems—market data feeds, CRM platforms, trading systems, compliance databases—can leverage Composio's pre-built library. Teams deploy AI agents accessing multiple data sources efficiently.

Best For: Banks prioritizing rapid deployment across multiple data sources

Deployment: Managed SaaS platform

Choosing the Right MCP Gateway

Compliance Requirements

Banks subject to SEC, FINRA, or international regulations should prioritize gateways with documented compliance certifications. MintMCP's SOC 2 Type II certification provides third-party validation that simplifies audit processes. Understanding MCP gateway security helps inform regulatory discussions.

Performance vs. Governance

High-frequency trading systems may prioritize low latency, while compliance-critical workloads benefit from comprehensive audit trails. Many banks deploy multiple gateways—performance-optimized for trading, compliance-certified for client-facing operations.

Infrastructure Alignment

Evaluate existing investments before selecting a gateway. Banks with mature Docker deployments, established Traefik configurations, or Azure standardization can extend current infrastructure. Greenfield implementations have flexibility to choose purpose-built platforms.

Integration Complexity

The financial AI workflows typical in investment banking require connections to trading systems, market data feeds, CRM platforms, and compliance databases. Platforms like MintMCP provide specialized connectors for governed access to data warehouses.

Monitoring and Observability

Without proper governance, AI tools operate as black boxes. An LLM proxy solution provides essential visibility into agent behavior—tracking tool calls, commands, and file access.

Conclusion: Transform AI Infrastructure with MintMCP

The Model Context Protocol has fundamentally changed how investment banks connect AI assistants to enterprise data and tools. As this analysis demonstrates, deploying MCP at scale requires enterprise-grade security, governance, and monitoring that transforms experimental AI into production-ready infrastructure.

MintMCP Gateway delivers the fastest path from pilot to production, offering one-click deployment with SOC 2 Type II certification that meets financial regulatory requirements. The platform removes the technical barriers that keep organizations in pilot mode, providing pre-built connectors for Snowflake data warehouses and Elasticsearch knowledge bases with complete audit trails and enterprise authentication.

Banks using standardized MCP integrations through MintMCP reduce development time significantly compared to building custom connections—transforming months of integration work into days of configuration. The platform's compliance-first architecture ensures security and governance are built in from day one, not added as afterthoughts.

Ready to transform your AI infrastructure? Visit MintMCP to schedule a demo and see how MintMCP Gateway can accelerate your enterprise AI deployment with the compliance, security, and governance that financial services demand.

Frequently Asked Questions

What is an MCP Gateway and why is it essential for investment banks?

An MCP Gateway centralizes the connection between AI agents and enterprise systems—handling authentication, permissions, audit trails, and security controls. For investment banks, gateways transform AI tools from ungoverned risks into compliant, auditable infrastructure. Without a gateway, banks face zero telemetry, no request history, and uncontrolled access—conditions incompatible with regulatory requirements. According to NIST guidelines, financial institutions must implement comprehensive access controls and continuous monitoring for all technology systems.

How do MCP Gateways ensure data security and compliance?

Enterprise MCP gateways provide OAuth 2.0 and SSO for authentication, complete audit logs for SOC 2 and GDPR compliance, and real-time monitoring for security alerts. The gateway layer ensures every AI tool interaction is authenticated, authorized, and logged—providing the documentation regulators expect during examinations.

How does MCP Gateway prevent Shadow AI?

Shadow AI—unauthorized AI tool usage—grows significantly year-over-year in enterprises. MCP gateways provide visibility into which AI tools teams use, track usage patterns, and enforce policies without slowing developers. Banks turn shadow AI into sanctioned AI by deploying MCP tools with pre-configured governance through enterprise MCP deployment.

Can MintMCP integrate with proprietary financial systems?

MintMCP's connector architecture supports integration with Snowflake data warehouses, Elasticsearch knowledge bases, and custom MCP servers. The platform enables banks to deploy proprietary integrations with the same governance and audit trail capabilities as standard connectors.

What makes MintMCP different from other gateways?

MintMCP provides SOC 2 certification purpose-built for regulated industries, one-click deployment that transforms local MCP servers into production services, and comprehensive audit trails satisfying SEC and FINRA requirements. The platform's compliance-first architecture delivers security and governance from day one, eliminating the need to retrofit compliance controls after deployment.