Financial institutions face mounting pressure to deploy AI capabilities while maintaining the security, compliance, and governance that regulators demand. Model Context Protocol (MCP) provides the standardized infrastructure that most banking executives now consider a strategic priority—enabling AI assistants to securely access customer data, transaction systems, and analytical tools without requiring custom integrations.

The MCP Gateway transforms this protocol from developer utility to production-grade infrastructure with OAuth protection, audit trails, and enterprise authentication.

Key takeaways

- MCP standardizes AI integration: Financial institutions using standardized protocols reduce development time by a lot compared to custom integrations, while banks implementing unified data access report faster response times for customer inquiries

- Compliance built in: Enterprise MCP gateways provide SOC2 Type II certification, GDPR-compliant audit trails, and OAuth/SAML enforcement required for financial services regulation

- Measurable ROI across functions: AI-powered compliance systems reduce false positives by 50-70%, fraud detection improves 3x faster than rule-based systems, and customer service automation cuts costs by a significant amount per interaction

- Implementation timeline: Initial deployments require 3-6 months with an investment of $150K-500 for development, but institutions see measurable improvements within the first quarter

- Governance imperative: 65% of financial institutions cite data security as the primary AI adoption barrier, making protocols with built-in monitoring and access controls essential

What is MCP and why financial services companies need IT

MCP is an open-source protocol developed by Anthropic that enables AI assistants like Claude, ChatGPT, and custom agents to securely connect with banking systems, databases, and enterprise tools through standardized server implementations. Rather than building separate integrations for each AI client and data source, MCP provides a universal integration layer that financial institutions can deploy once and use across their entire AI ecosystem.

The protocol architecture for banking

MCP operates through a client-server model where MCP servers expose specific capabilities—resources, tools, and prompts—that AI clients can access with proper authentication. For financial brands, this means:

- Centralized data access: AI assistants query customer accounts, transaction history, and compliance databases through a single standardized protocol rather than fragmented API connections

- Built-in security: OAuth 2.0, SAML, and role-based access controls ensure AI systems retrieve only authorized data with complete audit trails

- Flexible deployment: Support for stdio and Server-Sent Events (SSE) transport mechanisms enables both on-premises installations for sensitive operations and cloud deployments for customer-facing services

The GitHub MCP specification provides technical documentation, while the MCP architecture guide details implementation options. Financial institutions benefit from MCP's transparency—83% of fintech executives believe interoperability standards are critical for AI ecosystem growth, preferring open protocols over proprietary solutions for regulatory compliance and security auditing.

Why banks are adopting MCP now:

Financial services firms currently spend an average of $1.2 million annually on custom API integrations for AI systems. MCP eliminates this fragmentation by providing a single protocol that works across Claude, ChatGPT, Microsoft Copilot, and custom agents. The MintMCP Gateway adds enterprise hardening—one-click STDIO server deployment, automatic OAuth wrapping, and real-time monitoring—transforming local MCP implementations into production services that meet banking security standards.

1. Ai-powered customer support for banks and credit unions

Banks implementing AI assistants for customer inquiries reduce routine service requests by 35% while improving response consistency and availability. MCP enables this transformation by connecting AI agents to CRM systems, account databases, transaction histories, and knowledge bases through secure, governed integrations.

Implementation architecture

The Gmail MCP Server provides AI assistants with controlled email access for customer communications:

- Search and context retrieval: AI agents search historical support conversations using advanced query syntax to understand customer history before responding

- Draft generation workflow: Assistants create response drafts that human agents review before sending, maintaining quality control while accelerating response time

- Threading integrity: The draft_reply tool ensures responses maintain conversation context and proper email threading

Measurable outcomes

Financial institutions deploying conversational AI report 25% improvement in customer satisfaction scores, driven by:

- 24/7 availability for routine account inquiries

- Instant access to complete customer interaction history

- Consistent responses aligned with bank policies and compliance requirements

- Reduced wait times for complex issues as AI handles routine questions

2. Financial reporting and analytics automation with MCP

Finance teams using AI agents to access data warehouses automate reporting workflows that previously required SQL expertise and manual data compilation. The Snowflake MCP Server connects AI assistants to governed financial data for natural language analysis and automated report generation.

Core capabilities:

- Cortex Analyst integration: Converts natural language queries to SQL using semantic models, enabling executives to request "revenue variance by product line for Q4" without writing database queries

- Semantic view querying: AI agents access pre-configured dimensions, metrics, and facts with proper data governance and lineage tracking

- Automated report generation: Schedule AI-driven financial dashboards that compile data from multiple sources and format executive summaries

Business value for financial institutions

Product management teams use AI to analyze user behavior and transaction patterns directly from Snowflake warehouses. Finance teams automate:

- Monthly close processes with variance analysis highlighting significant deviations

- Budget versus actual reports with natural language explanations of discrepancies

- Forecasting models that incorporate historical trends and market conditions

- Regulatory financial reports with automated data validation

Governance framework

The MCP Gateway provides centralized governance for data warehouse access:

- Granular tool access control configures read-only operations and excludes write tools for AI agents

- Shared service accounts at the admin level or individual OAuth flows for user-specific data access

- Real-time usage monitoring tracks which AI tools query sensitive financial data

- Complete audit logs for SOC2 and GDPR compliance reviews

Financial institutions report 60-80% processing time reductions for routine reporting tasks, freeing analysts to focus on strategic analysis rather than data compilation.

3. Fraud detection and prevention through mcp-enabled AI

Real-time fraud detection systems connected via MCP analyze transaction patterns, device fingerprints, and behavioral biometrics to identify fraudulent transactions faster than rule-based systems while reducing false declines by 50%.

Technical implementation

The Elasticsearch MCP Server enables AI agents to perform semantic searches across application logs and transaction data:

- Pattern recognition: The search tool uses query DSL to identify unusual transaction sequences, velocity patterns, and geographic anomalies

- ES|QL analytics: Execute advanced queries to correlate fraud indicators across multiple data dimensions

- Historical analysis: AI agents analyze resolved fraud cases to identify new attack patterns before they scale

Operational benefits

Support teams empower AI to search historical fraud tickets, resolution patterns, and investigation notes for faster case resolution. Risk teams configure AI agents to:

- Monitor transaction streams in real-time for immediate fraud scoring

- Flag transactions that match known fraud patterns while learning new indicators

- Generate investigation reports with supporting evidence from multiple systems

- Provide fraud analysts with contextual recommendations for case prioritization

4. Wealth management and investment advisory with AI agents

A significant number of financial advisors now use AI tools for portfolio analysis and investment recommendations, leveraging MCP to securely access client holdings, market data, and risk parameters while maintaining fiduciary standards.

Mcp-enabled portfolio management

AI-powered advisory tools access customer data through the MCP Gateway to provide:

- Personalized portfolio analysis: AI evaluates asset allocation, diversification, sector exposure, and risk-adjusted returns based on client-specific goals and risk tolerance

- Rebalancing recommendations: Automated analysis identifies portfolio drift and suggests trades to maintain target allocations while minimizing tax impact

- Market correlation analysis: AI agents access market data feeds to assess portfolio sensitivity to economic scenarios and geopolitical events

- Compliance-checked advice: Every AI recommendation includes regulatory disclosure requirements and suitability documentation

Governance requirements for investment AI

Wealth management applications demand rigorous oversight due to fiduciary responsibilities:

- Role-based data access: Junior advisors' AI tools access different client segments than senior wealth managers based on relationship responsibility

- Explainable recommendations: AI must document the reasoning behind every portfolio suggestion for regulatory compliance

- Approval workflows: Investment recommendations require human advisor review before client presentation

- Complete audit trails: Every AI-generated recommendation, data access, and client interaction is logged for compliance review

5. Automated compliance monitoring and regulatory reporting

AI systems monitoring transaction streams through MCP detect suspicious activities, flag regulatory requirements, and generate compliance documentation—reducing compliance team workload by 50-70% while improving detection accuracy.

Real-Time compliance applications:

- AML/KYC monitoring: AI analyzes transaction patterns against sanctions lists, politically exposed person databases, and behavioral baselines to identify potential money laundering

- Regulatory reporting automation: AI systems compile required data from distributed banking systems for OFAC, FinCEN, and other regulatory submissions

- Policy enforcement: Automated systems verify transactions comply with lending limits, concentration restrictions, and regulatory requirements

- Audit trail generation: AI maintains comprehensive documentation of compliance decisions for regulatory examination

Implementation benefits

Banks deploying AI compliance monitoring report:

- 5–70% reduction in false positive alerts that waste investigator time

- 45% decrease in regulatory report preparation time

- Improved detection of complex money laundering schemes through pattern recognition

- Consistent application of compliance policies across all transactions and customer interactions

Governance framework

The LLM Proxy provides essential oversight for AI compliance systems:

- Tool call tracking: Monitor every MCP tool invocation to ensure AI accesses only authorized compliance data

- Command history: Complete audit trail of AI decisions for regulatory review

- Sensitive file protection: Prevent AI from accessing credentials or configuration files containing compliance system parameters

- Real-time blocking: Stop dangerous operations before execution if AI attempts unauthorized data access

Compliance officers using AI-assisted systems accelerate report generation from weeks to days while maintaining the documentation rigor that regulators require. The automated systems also identify compliance gaps earlier—flagging issues before they become regulatory violations.

6. Credit risk assessment and lending decisions

AI models evaluate loan applications through MCP access credit bureau data, banking history, and alternative data sources to reduce approval time from days to minutes while decreasing default rates by 15-20%.

Comprehensive risk evaluation

MCP connects AI credit models to multiple data sources for holistic assessment:

- Traditional credit bureau reports and FICO scores

- Banking relationship history, including deposit patterns and overdraft frequency

- Alternative data, such as utility payments, rent history, and education credentials

- Income verification through employer databases and tax records

Business impact for lenders

Financial institutions implementing AI-powered credit assessment achieve:

- Near-instant loan decisions for standard applications

- Expanded lending to underbanked populations through alternative data analysis

- Consistent credit policies applied across all applications

- Reduced manual underwriting costs for routine applications

Regulatory compliance requirements

Credit decision AI must meet strict regulatory standards:

- Explainable decisions: AI provides specific factors contributing to approval/denial for adverse action notices

- Fair lending compliance: Models undergo bias testing to ensure equal treatment across protected classes

- Human oversight: High-risk or edge cases escalate to human underwriters

- Audit documentation: Complete record of data sources, model versions, and decision logic for regulatory examination

The MCP Gateway ensures credit AI operates within approved parameters through granular tool access control—enabling read access to credit data while preventing AI from directly modifying credit decisions or customer records without human approval.

7. Regulatory reporting automation and data compilation

AI systems compiling regulatory reports through MCP automate data collection, validation, and formatting—reducing report preparation time by up to 80% while minimizing human error in data compilation.

Automated reporting workflows

MCP enables AI to access distributed data sources for comprehensive reporting:

- Core banking systems for transaction data and account information

- Trading platforms for investment activity and position data

- Risk management systems for exposure calculations and stress test results

- Compliance databases for KYC documentation and suspicious activity reports

Reporting applications

Financial institutions automate:

- Call report submissions to regulatory agencies

- FINRA reporting for broker-dealers

- Dodd-Frank data submissions

- Basel III capital adequacy calculations

- CECL credit loss estimations

Quality improvements

Automated reporting systems provide:

- Consistent data extraction and formatting across reporting periods

- Real-time validation that identifies data quality issues before submission

- Version control and change tracking for audit trails

- Automated reconciliation between source systems and regulatory reports

The Snowflake MCP Server enables AI to query data warehouses where financial institutions consolidate regulatory data, using natural language to generate complex reports that previously required specialized SQL expertise.

Compliance and security requirements for MCP in financial services

65% of financial institutions cite data security as the primary barrier to AI adoption. MCP implementations in banking require enterprise-grade security controls that meet regulatory standards for customer data protection and audit compliance.

Essential Security Controls:

- SOC 2 Type II attestation: The MCP Gateway provides SOC 2 compliance with comprehensive security controls for data protection, availability, and confidentiality

- GDPR audit trails: European operations demand complete data access logs, right-to-deletion capabilities, and data residency controls

- OAuth 2.0 and SAML: Enterprise authentication integrates with existing identity providers for consistent access management across banking systems

Regulatory framework compliance

MCP implementations must address multiple regulatory requirements:

- GLBA (Gramm-Leach-Bliley Act): Requires financial institutions to protect customer information and provide privacy notices

- PCI-DSS: Payment card data accessed by AI must meet cardholder data security standards

- FFIEC guidelines: Federal banking regulators require risk-based authentication and security controls for online banking

- State data breach laws: Require notification protocols if AI systems experience unauthorized data access

Data residency and sovereignty

Multi-region support with data residency controls ensures:

- Customer data remains in jurisdictions required by law (EU data stays in EU, Canadian data in Canada)

- AI processing occurs in approved geographic regions

- Audit logs and security monitoring comply with local regulations

- Cross-border data transfer meets legal requirements

The MCP Gateway's OAuth and SSO enforcement automatically wraps MCP endpoints with enterprise authentication, while comprehensive audit logging tracks every AI interaction for compliance review.

Deploying MCP servers securely in financial institutions

Banks implementing MCP face technical challenges deploying STDIO-based servers in production environments. The MCP Gateway addresses these deployment barriers with an enterprise infrastructure that transforms local development into production services.

From development to production:

- One-click STDIO hosting: Deploy STDIO-based MCP servers instantly with automatic containerization and lifecycle management

- OAuth protection: Add enterprise authentication to any local MCP server automatically without code changes

- Centralized registry: Maintain a catalog of approved MCP servers with version control and access policies

- Virtual servers: Create curated MCP endpoints that expose only required tools rather than entire server capabilities

Enterprise deployment options

Financial institutions choose deployment models based on regulatory and operational requirements:

- Cloud hosting: MintMCP-managed infrastructure with enterprise SLAs and multi-region availability

- Self-hosted options: Deploy MCP Gateway on bank infrastructure for complete control (available on roadmap)

- Hybrid approach: Cloud-hosted for customer-facing AI, on-premises for core banking integrations

Infrastructure requirements

Production MCP deployments require:

- High availability with automatic failover for business continuity

- Multi-region support for global operations and disaster recovery

- Real-time monitoring dashboards for server health and usage patterns

- Integration with existing API management and security tools

Configuration management

The MCP Gateway provides centralized management for enterprise deployments:

- Unified authentication across all MCP connections

- Granular tool access control configured by role (read-only operations, excluded write tools)

- Rate limiting to prevent AI systems from overloading backend services

- Comprehensive logging of every tool invocation for security review

Banks reduce development time by using standardized MCP versus custom API integrations, while the Gateway's enterprise hardening ensures local servers meet production security standards.

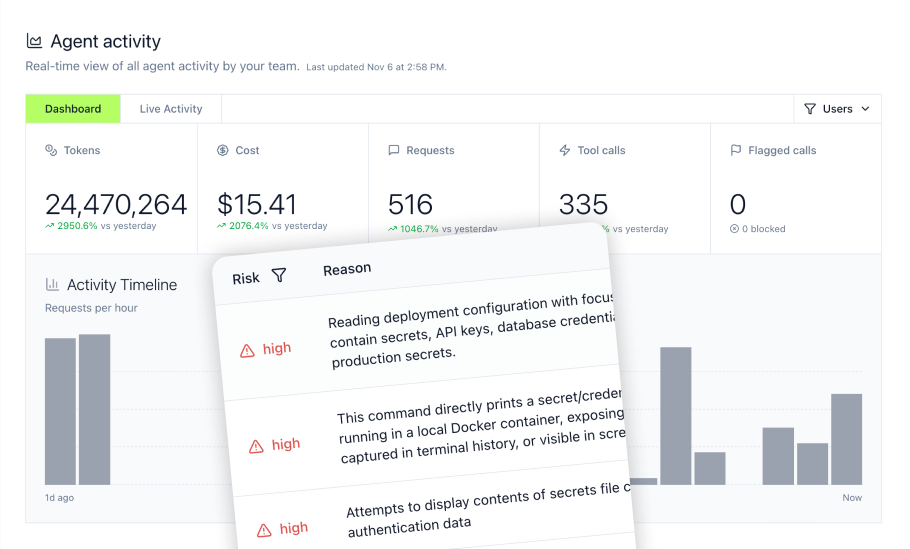

Monitoring and governance: Observability for financial AI tools

Financial institutions require complete visibility into AI system behavior to meet regulatory requirements and manage operational risk. The LLM Proxy provides real-time monitoring and control for AI agents accessing banking systems through MCP.

Comprehensive tool call tracking

Monitor every AI interaction with banking systems:

- MCP tool invocations: Track which AI tools query customer data, execute transactions, or access sensitive systems

- Bash command monitoring: See the commands AI agents execute when accessing infrastructure or running scripts

- File access logging: Monitor which files AI reads, writes, or modifies during operations

- API call tracking: Record every external API the AI contacts and the data exchanged

Security guardrails

Block dangerous operations before they execute:

- Command blacklisting: Prevent AI from running commands that could compromise security (reading .env files, accessing SSH keys, modifying credentials)

- File protection rules: Block access to sensitive configuration files and credential stores

- API restrictions: Limit which external services AI can contact

- Real-time alerts: Notify security teams when AI attempts unauthorized operations

Governance dashboards

Real-time monitoring provides:

- Usage analytics showing which AI tools teams use most frequently

- Performance metrics for response times and error rates

- Cost allocation tracking AI spending per department or project

- Security alerts highlighting policy violations or suspicious behavior

Compliance audit trails

Complete documentation for regulatory examination:

- Every data access is logged with a timestamp, the user, and the purpose

- Tool invocation history showing AI decision logic

- Error and exception logging for troubleshooting

- Exportable reports for SOC2 and GDPR compliance reviews

The LLM Proxy sits between AI clients (Cursor, Claude Code, ChatGPT) and backend systems, forwarding requests while maintaining complete observability. Financial institutions gain the visibility regulators demand while enabling developers to use AI tools safely.

Making your choice: Essential implementation considerations

Start with Compliance-First use cases

Financial institutions should prioritize MCP implementations where regulatory requirements are well-understood:

- Customer service automation with read-only data access

- Internal knowledge base search for employee productivity

- Analytics and reporting with existing data governance

- Non-customer-facing operations that don't require GLBA compliance

High-risk applications like automated lending or trading decisions require additional regulatory guidance before MCP deployment.

Pilot before production

Conduct proof-of-concept with non-production data to:

- Assess integration complexity with core banking systems

- Evaluate security features against institutional requirements

- Measure performance benchmarks for customer-facing latency

- Test disaster recovery and failover capabilities

Typical pilot timelines: 30-60 days for assessment, 90-120 days for limited production deployment.

Build governance framework first

Establish AI oversight before deploying production systems:

- AI ethics board to review high-risk use cases

- Clear data usage policies defining permissible AI access

- Model risk management framework for credit and investment AI

- Incident response procedures for security events

Evaluate total cost of ownership

MCP implementation costs include:

- Development resources: An estimate of $150K-500K for initial deployment

- Ongoing maintenance: 15-20% of initial investment annually

- Security audits and compliance reviews

- Staff training on AI governance and monitoring tools

Compare against current custom integration costs averaging $1.2 million annually—most institutions achieve ROI within 12-24 months.

Choose Enterprise-Grade infrastructure

Production MCP deployments require:

- SOC2 Type II certification for security controls

- Multi-region deployment with data residency controls

- Enterprise SLAs with automatic failover and 99.9%+ uptime

The MCP Gateway provides these capabilities out of the box, accelerating time-to-production while ensuring regulatory compliance.

Frequently asked questions

Q: What is MCP and how does IT work in financial services?

A: MCP is an open standard from Anthropic that lets AI apps (clients) securely talk to external systems via MCP servers (for data/tools). Banks can expose read/write capabilities behind auth, and AI clients discover and call those tools over the client-server protocol. See the spec and introductions from Anthropic and GitHub’s MCP Registry.

Q: How do financial institutions deploy MCP servers securely?

A: Use managed/registry-backed servers where available, add enterprise auth (e.g., OAuth/SSO), and centralize policy/audit. Cloudflare documents remote MCP connections; Snowflake offers a managed MCP server; many teams run servers in containers with org SSO and logging. Timelines and costs vary by scope—plan weeks to months for production hardening.

Q: What are the top MCP use cases for banks and credit unions?

A: Common patterns: (1) customer support assistants that can securely fetch account context; (2) supervised actions (e.g., dispute workflows) via APIs; (3) compliance/recon/reporting queries over governed data; (4) fraud ops workflows that search logs/events; (5) portfolio and risk analysis against data warehouses. Use MCP for live, governed actions; use RAG for large static corpora.

Q: Can MCP integrate with snowflake or elasticsearch?

A: Yes. Snowflake’s managed MCP exposes Cortex tools so assistants can ask NL questions that become SQL (read scopes recommended for finance). Elastic provides MCP options (Agent Builder MCP endpoint for ES 9.2+/Serverless) for semantic/log search and KB retrieval.

Q: How does MCP improve customer support in financial services?

A: MCP lets assistants securely search tickets/KBs, fetch account data, and draft compliant replies—while keeping actions/audit centralized. Impact varies by org; treat deflection/CSAT lifts as case-by-case and measure with guardrails (read-only by default, approval for sends/writes).