Connecting payment infrastructure to AI systems securely requires balancing automation with compliance. The Model Context Protocol provides a standardized approach to connect AI agents with Stripe's payment APIs, enabling intelligent automation of billing workflows, customer management, and financial operations. However, deploying these connections at enterprise scale demands proper infrastructure that traditional local installations cannot provide. This guide shows finance and DevOps teams how to implement Stripe MCP integrations that meet enterprise security requirements while enabling AI-powered payment automation.

Key takeaways

- MCP standardizes how AI agents interact with Stripe APIs, replacing fragmented custom integrations with a unified protocol for payment operations

- Stripe's official MCP server provides access to customers, subscriptions, invoices, payment intents, refunds, and product management through natural language interactions

- Enterprise deployments require centralized authentication, PCI compliance considerations, and audit trails that local MCP servers cannot provide

- MintMCP's gateway architecture enables one-click deployment of Stripe MCP servers with automatic OAuth protection and enterprise monitoring

- MCP's optional authentication creates security gaps that enterprises must address through restricted API keys, OAuth, or SSO integration

- Hosted connectors eliminate the need for teams to manage infrastructure while maintaining complete audit trails for financial compliance

- Stripe MCP integration reduces manual payment management tasks while providing AI agents with real-time access to billing data and transaction history

What is MCP and why Stripe MCP matters

The Model Context Protocol is an open standard that enables developers to build secure, two-way connections between their data sources and AI-powered tools. For finance teams, this means AI agents can interact with Stripe payment systems, manage subscriptions, process refunds, and automate billing workflows without requiring custom API integrations for each tool.

Traditional Stripe integrations follow a fragmented approach. Every AI tool, IDE, or automation system requires its own authentication setup, API wrapper, and maintenance overhead. When you need to connect Claude, ChatGPT, Cursor, and internal automation tools to Stripe, you maintain four separate integrations with different authentication patterns and no centralized audit trail.

MCP acts as a bridge between AI applications and external APIs. MCP servers expose external functionality as standardized tools. AI clients access and invoke these tools without prior knowledge of implementation details. This standardization dramatically reduces integration complexity while improving security and observability.

Stripe MCP server capabilities

Stripe's official MCP server connects AI tools directly to Stripe's payment platform, giving AI agents, assistants, and chatbots the ability to manage customers, process payments, handle subscriptions, and automate financial operations through natural language interactions.

The server provides these core toolsets:

Customer Management

- Create and list customers with complete profile data

- Query customer information and payment history

- Update customer details and metadata

- Search customers across accounts

Payment Processing

- List payment intents and transaction history

- Create payment links for customer checkout

- Process refunds with automatic validation

- Monitor payment status and failures

Subscription Management

- List active subscriptions across customers

- Update subscription plans and pricing

- Cancel subscriptions with proration handling

- Manage subscription schedules

Billing & Invoicing

- Create invoices with line items

- Finalize invoices for payment collection

- List invoice history and payment status

- Create invoice items for flexible billing

Product & Pricing

- Create products with descriptions and metadata

- Define pricing models and tiers

- List products and prices across catalog

- Manage coupons and promotional offers

Dispute Management

- List disputes requiring attention

- Update dispute responses with evidence

- Track dispute status and outcomes

- Monitor chargeback ratios

Account Operations

- Retrieve Stripe account information

- Check account balance and pending funds

- Search across Stripe resources

- Access Stripe knowledge base documentation

Why finance teams need enterprise MCP infrastructure

MCP prioritizes developer convenience over enterprise security. The protocol supports OAuth and other authentication methods, but implementation is optional and almost universally skipped. This creates significant risks for enterprise deployments involving financial data.

Running Stripe MCP servers locally on developer machines introduces these problems:

- Credential Sprawl: Stripe API keys stored in configuration files across hundreds of developer laptops without secure key management

- No Audit Trail: Zero visibility into which payment operations AI agents perform or what customer data they access

- Access Control Gaps: No centralized way to revoke access or enforce role-based permissions for financial operations

- Compliance Violations: Inability to demonstrate SOC2, PCI DSS, or financial audit compliance without comprehensive logging

- Key Rotation Risk: No mechanism to rotate compromised API keys across distributed installations

Enterprise finance teams require infrastructure that provides authentication, authorization, audit logging, and governance controls for payment operations—capabilities that local MCP servers simply cannot deliver.

Understanding MintMCP gateway architecture for Stripe

MintMCP's enterprise gateway solves the deployment challenge by running MCP servers in managed infrastructure with centralized security controls. Rather than asking every team member to manage local installations, administrators configure Stripe MCP connectors once and provide governed access through Virtual MCP servers.

How the gateway works

The gateway operates as a proxy layer between AI agents and Stripe APIs:

- Connector Registration: Administrators add Stripe MCP servers as connectors through the MintMCP console

- Virtual Server Creation: Connectors are bundled into Virtual MCP servers with curated tool collections for specific teams

- Unified Authentication: Team members authenticate with MintMCP and complete downstream OAuth flows only when required

- Request Routing: AI agents send tool requests to the Virtual MCP endpoint, which routes them through the gateway

- Audit Logging: Every interaction flows through MintMCP, creating comprehensive audit trails

This architecture provides critical benefits for finance operations:

- Deploy Once, Use Everywhere: Register Stripe connectors once and share across multiple Virtual MCP servers tailored to different teams

- Centralized Credential Management: Administrators configure authentication at the connector level instead of managing API keys across individual machines

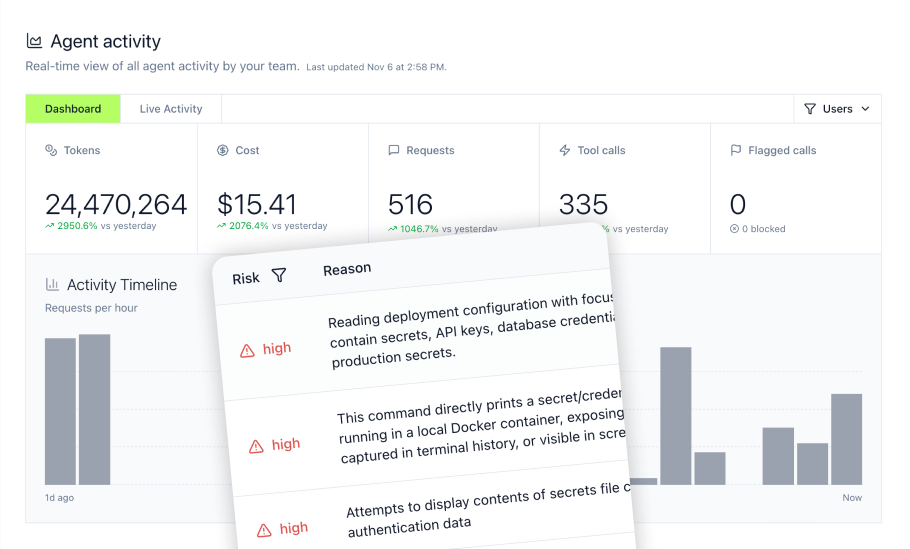

- Complete Observability: Monitor which payment operations agents perform, what customer data they access, and track usage patterns

- Enterprise Security: SOC2 Type II certified infrastructure with encryption, access controls, and compliance-ready logging

Three deployment patterns for Stripe MCP

MintMCP supports three approaches to deploying Stripe MCP connectors, each suited to different enterprise requirements:

Remote MCP Connectors

Point the gateway at Stripe's remote MCP server hosted at https://mcp.stripe.com that Stripe maintains. This option provides the easiest deployment path with automatic updates and Stripe-managed infrastructure. Use remote connectors when you want minimal operational overhead and can rely on Stripe's hosted service.

Hosted MCP Connectors

Supply the standard STDIO configuration for Stripe's open-source MCP server and let MintMCP run it in managed infrastructure. This approach gives you control over the server version and configuration while MintMCP handles container lifecycle, scaling, and monitoring. Hosted connectors work well when you need specific toolset configurations or want to customize server behavior.

Custom MCP Connectors

Build and deploy your own Stripe MCP server implementation with custom functionality. Package the artifacts and deploy onto MintMCP's managed runtime for complete control over features and integration logic. Use custom connectors when you need to extend Stripe functionality with internal financial systems or implement specialized workflows.

All three patterns enforce the same authentication, authorization, and logging policies described in the gateway architecture documentation.

Step-by-Step: Deploying Stripe MCP with MintMCP

This section walks through deploying Stripe MCP integration for your finance team using the hosted connector approach, which balances ease of deployment with configuration flexibility.

Prerequisites

Before starting, ensure you have:

- MintMCP account with administrator privileges

- Stripe account with appropriate payment processing setup

- Stripe restricted API key or OAuth app credentials

- Clear understanding of which teams need access to which payment operations

Creating a Stripe restricted API key

Your Stripe MCP connector needs authentication credentials to access payment data and perform operations. Stripe strongly recommends using restricted API keys instead of secret keys to limit access to only required functionality.

For initial deployment, create a restricted API key:

- Navigate to Stripe Dashboard → Developers → API keys

- Click "Create restricted key"

- Set key name (e.g., "MintMCP Stripe Connector")

- Choose appropriate expiration based on your key rotation policy

- Select required permissions based on your needs:

- Customers: Write access for customer management

- Payment Intents: Read access for transaction monitoring

- Subscriptions: Write access for subscription management

- Invoices: Write access for billing operations

- Products & Prices: Write access for catalog management

- Refunds: Write access for refund processing

- Disputes: Write access for dispute responses

- Restrict to specific IP addresses if possible

- Generate key and store securely

Stripe requires using restricted API keys instead of secret keys for enhanced security. Secret keys (beginning with sk_) provide unrestricted access to all API operations, while restricted keys (beginning with rk_) limit permissions to specific resources and actions.

For production deployments, implement key rotation policies and migrate to OAuth 2.0 flows that provide per-user authentication and automatic token refresh.

Configuring the hosted Stripe MCP connector

Navigate to the MintMCP console and follow these steps:

-

Add Connector

- Go to MCP Connectors section

- Click "Add Connector"

- Select "Hosted Server" option

-

Configure Server Settings

Paste the MCP standard configuration for Stripe's official server:

{

"mcpServers": {

"stripe": {

"command": "npx",

"args": [

"-y",

"@stripe/mcp",

"--tools=all"

],

"env": {

"STRIPE_SECRET_KEY": "<your-restricted-key>"

}

}

}

}

For selective tool access, specify individual tools instead of --tools=all:

{

"mcpServers": {

"stripe": {

"command": "npx",

"args": [

"-y",

"@stripe/mcp",

"--tools=customers.create,customers.read,subscriptions.list,invoices.create"

],

"env": {

"STRIPE_SECRET_KEY": "<your-restricted-key>"

}

}

}

}

- Set Environment Variable Scopes

STRIPE_SECRET_KEY: Set to "Global" for organization-wide access with a service account key, or "Per-User" to prompt each user for their own key- This decision impacts audit attribution and access control granularity

- Deploy and Verify

- Click "Save" to trigger deployment

- MintMCP launches the server in a managed container

- Monitor the connector detail page for startup logs and available tools

The deployment typically completes within 30-60 seconds. If the server fails to start, check logs for common issues like invalid API keys or missing dependencies.

Check the official Stripe MCP server repository for the latest installation methods and configuration options, as deployment approaches may be updated.

Creating virtual MCP servers for team access

With the Stripe connector deployed, create Virtual MCP servers that bundle tools for specific teams. This approach prevents over-privileging by exposing only the minimum required capabilities.

Finance Team Virtual Server

Create a Virtual MCP server for finance team members who need comprehensive Stripe access:

- Navigate to Virtual MCP Servers

- Click "Create Virtual Server"

- Name it "Stripe - Finance Full Access"

- Add your Stripe connector

- Enable all toolsets: customers, payment_intents, subscriptions, invoices, products, refunds, disputes

- Configure tool customization to expose all available tools

- Set team members who should have access

Customer Support Team Virtual Server

Create a restricted Virtual MCP server for support representatives:

- Create new Virtual Server named "Stripe - Support Access"

- Add the same Stripe connector

- Enable limited toolsets: customers.read, subscriptions.list, invoices.list, refunds.create

- Use tool customization to remove write operations on customers

- Assign to customer support team members

Billing Operations Team Virtual Server

Create a billing-focused Virtual MCP server:

- Create Virtual Server named "Stripe - Billing Operations"

- Add Stripe connector

- Enable only: invoices, subscriptions, products, prices

- Expose only billing-related tools

- Assign to billing operations team members

This pattern implements role-based access control at the tool level, ensuring teams only access capabilities appropriate for their financial responsibilities.

Connecting AI agents to virtual MCP servers

Once Virtual MCP servers are configured, team members connect their AI agents using the published endpoints. The connection process varies by AI tool:

Claude Desktop Configuration

In Claude Desktop, go to Settings → Connectors → Add custom connector. Paste your VMCP URL (from MintMCP) and finish setup. This is the officially supported way to use remote MCP servers in Claude Desktop.

ChatGPT Custom Actions

Configure the Virtual MCP server as a Custom GPT action:

- Generate OpenAPI specification from the Virtual MCP endpoint

- Create new Custom GPT with generated spec

- Configure OAuth 2.0 authentication pointing to MintMCP

- Team members authenticate when first using the GPT

VS Code Copilot Integration

Configure the Virtual MCP server in VS Code's MCP settings:

- Open VS Code settings

- Navigate to MCP Servers configuration

- Add remote MCP server with Virtual MCP endpoint URL

- Authenticate through MintMCP OAuth flow

Each connection method maintains individual user attribution for audit purposes while routing requests through the centralized gateway.

Implementing enterprise security controls

Stripe MCP integration introduces security challenges that traditional API security frameworks cannot address. MCP breaks traditional security assumptions through autonomous decision-making, dynamic tool discovery, unpredictable execution, and context injection.

Authentication strategy: From prototypes to production

Enterprise deployments should follow a staged authentication approach:

Stage 1: Prototype with Restricted API Keys

Initial proof-of-concept deployments can use restricted API keys for rapid testing:

- Configure keys with minimum required permissions for intended operations

- Set IP address restrictions when possible

- Store in MintMCP's encrypted environment variables

- Plan migration path to OAuth before production

- Implement 90-day key rotation policy

Stage 2: OAuth 2.0 for Production

Production deployments require OAuth 2.0 for per-user attribution:

- Configure Stripe OAuth app for your organization

- Integrate with MintMCP OAuth flows

- Each user completes OAuth authorization on first Virtual MCP access

- Tokens refresh automatically without user intervention

- Comprehensive audit trails show which user performed each operation

Stage 3: Enterprise SSO Integration

Large enterprises with centralized identity management need SAML/SSO:

- Integrate MintMCP with Okta, Azure AD, or other identity providers

- Users authenticate once with SSO credentials

- MintMCP obtains Stripe tokens through configured OAuth flows

- Access revocation happens at identity provider level

- Complete compliance with identity management policies

MintMCP's authentication architecture supports all three stages, enabling gradual migration as deployment matures.

Implementing tool governance policies

Tool descriptions inject content directly into AI prompts, creating injection attack vectors that require governance and sanitization controls. MintMCP provides multiple layers of tool governance:

Tool Curation at Virtual Server Level

Not all teams need access to all Stripe capabilities. Virtual MCP servers let administrators curate tool collections:

- Finance teams: Full read/write access to all payment operations

- Support teams: Read-only customer access, limited refund capabilities

- Billing teams: Invoice and subscription tools only, no customer data access

- Analytics teams: Read-only access for reporting and analysis

Selective Tool Enablement

Instead of exposing all Stripe tools, specify only required capabilities:

- Customer service:

customers.read,subscriptions.list,refunds.create - Billing operations:

invoices.create,invoices.finalize,subscriptions.update - Financial reporting: Read-only access across all resource types

Configure selective tools by listing specific capabilities in the connector configuration instead of using --tools=all.

Real-Time Security Rules

MintMCP's LLM proxy rules enable blocking dangerous operations before they execute:

- Block refunds exceeding specified amounts without approval

- Prevent subscription cancellations for high-value customers

- Require approval workflows for bulk operations

- Flag suspicious patterns for security review

Create rules through the MintMCP console at the gateway level, applying consistent policies across all Virtual MCP servers.

Audit and compliance requirements

Payment operations access sensitive financial data and require comprehensive logging for regulatory compliance and incident investigation. Enterprise Stripe integrations must maintain detailed audit trails for multiple frameworks.

PCI DSS Compliance Considerations

While Stripe maintains PCI Level 1 Service Provider certification, businesses using Stripe must ensure their integrations remain compliant. MintMCP provides:

- Comprehensive logging of all payment operations with user attribution

- Access control enforcement with role-based permissions

- Secure credential management for Stripe API keys

- Incident response capabilities with alerting and notifications

- Continuous monitoring through the activity log

Organizations must complete appropriate Self-Assessment Questionnaires based on their Stripe integration method and transaction volume.

SOC2 Type II Compliance

MintMCP provides SOC2 Type II certification out of the box, eliminating the need to build custom compliance infrastructure. The platform automatically generates comprehensive audit trails showing who accessed which payment data, what operations they performed, and when each action occurred.

Financial Audit Requirements

For organizations subject to financial audits, MintMCP's audit and observability features generate compliance reports demonstrating policy enforcement, access controls, and security incident handling required for auditors.

Integrating Stripe MCP with financial workflows

Stripe MCP integration enables AI-powered automation across billing operations, customer management, and revenue operations workflows.

Automated subscription management

AI agents with Stripe MCP access can automate subscription workflows:

Proactive Customer Retention

Configure AI agents to:

- Monitor subscription cancellation requests

- Analyze customer usage patterns and payment history

- Generate personalized retention offers

- Apply promotional pricing or plan changes

- Create customer communication workflows

Dunning Management

AI agents handle failed payment recovery:

- Monitor failed payment attempts automatically

- Update payment methods with customer consent

- Create retry schedules based on failure reasons

- Send customized dunning communications

- Escalate persistent failures to support teams

Invoice and billing automation

Automate invoice generation and management workflows:

Usage-Based Billing

AI agents calculate and invoice usage:

- Aggregate usage data from multiple systems

- Create invoice items with detailed descriptions

- Apply tiered pricing and volume discounts

- Finalize invoices on scheduled cadence

- Handle proration for mid-cycle changes

Payment Collection

Agents orchestrate payment workflows:

- Generate payment links for outstanding invoices

- Send automated payment reminders

- Process partial payments with remaining balances

- Apply customer credits and refunds

- Update accounting systems with payment status

Customer support automation

Enable support teams with AI-powered Stripe access:

Intelligent Refund Processing

AI agents evaluate refund requests:

- Analyze customer history and payment patterns

- Calculate appropriate refund amounts

- Process refunds within policy guidelines

- Update support tickets with refund status

- Flag unusual refund patterns for review

Subscription Modifications

Agents handle plan changes efficiently:

- Compare current and target subscription plans

- Calculate prorated charges for upgrades

- Process immediate or scheduled changes

- Update customer billing information

- Communicate changes to customers

Financial reporting and analytics

AI agents generate insights from Stripe data:

Revenue Analysis

Agents compile financial reports:

- Aggregate revenue by product, plan, or customer segment

- Calculate monthly recurring revenue and growth rates

- Identify churn patterns and retention metrics

- Compare actuals against forecasts

- Generate executive dashboards automatically

Compliance Reporting

Agents maintain compliance documentation:

- Track dispute rates and chargeback ratios

- Monitor payment failure trends

- Generate reconciliation reports

- Identify anomalous transaction patterns

- Create audit-ready documentation

Monitoring and observability for Stripe MCP

Comprehensive monitoring ensures your Stripe MCP integration operates reliably and securely. MintMCP's observability features provide visibility into every aspect of the system.

Activity log and audit trails

The MintMCP activity log captures every Stripe MCP interaction:

- User who initiated each payment operation

- Timestamp and duration

- Tool called and arguments provided

- Customer or transaction data accessed

- Virtual MCP server used

- Success or failure indicators

This comprehensive logging enables:

- Financial audit responses with complete attribution

- Security incident investigation for suspicious activities

- Usage pattern analysis for optimization

- Performance monitoring across operations

- Anomaly detection for fraud prevention

Performance metrics to track

Monitor these key metrics for healthy Stripe MCP operations:

Request Latency

- Average response time per tool operation

- 95th percentile latency for payment processing

- Timeout frequency for long-running operations

- Geographic latency distribution

Error Rates

- Failed requests by error type and cause

- Authentication failures indicating credential issues

- Rate limit hits from excessive API usage

- Payment processing errors by failure reason

Usage Patterns

- Most frequently called tools by team

- Peak usage times for capacity planning

- Per-user request volumes for fair use

- Customer data access frequency

Financial Metrics

- Transaction volumes and values processed

- Refund rates and amounts

- Subscription changes and churn events

- Dispute frequency and resolution rates

Setting up alerts and notifications

Configure proactive monitoring through MintMCP's alerting system:

Security Alerts

- Failed authentication attempts exceeding threshold

- Unusual access patterns indicating compromised credentials

- High-value refunds requiring approval

- Bulk operations on customer data

Operational Alerts

- Connector failures or unavailability

- Elevated error rates indicating API issues

- Rate limit approaching exhaustion

- Performance degradation beyond SLA thresholds

Financial Alerts

- Unexpected transaction volumes or values

- Refund rates exceeding policy thresholds

- Subscription cancellation spikes

- Payment failure rate increases

MintMCP supports Slack notification actions for real-time alerting when critical events occur.

Troubleshooting common Stripe MCP integration issues

Authentication and authorization problems

Issue: Users Cannot Authenticate with Virtual MCP Server

Symptoms: OAuth flow fails, users see permission denied errors, API keys rejected

Solutions:

- Verify restricted API key has required permissions in Stripe Dashboard

- Check key has not expired or been revoked

- Ensure key restrictions (IP addresses) allow MintMCP infrastructure

- Confirm environment variables are properly configured

- Review connector logs for authentication error details

Issue: API Key Permissions Insufficient

Symptoms: Certain operations fail, permission errors in logs, tools return access denied

Solutions:

- Review required permissions for each tool in Stripe documentation

- Update restricted API key with additional permissions

- Redeploy connector with updated credentials

- Test operations individually to isolate permission gaps

- Consider using separate keys for different Virtual MCP servers

Connector deployment failures

Issue: Hosted Connector Won't Start

Symptoms: Connector status shows "failed", logs indicate startup errors

Solutions:

- Verify environment variables are correctly configured

- Check Stripe API key format matches expected pattern

- Ensure command and arguments match official server specification

- Review logs for missing dependencies or version conflicts

- Test configuration locally before deploying to MintMCP

Issue: Tools Not Appearing in Virtual MCP Server

Symptoms: Connector running but no tools available, empty tool list

Solutions:

- Confirm tool configuration includes desired capabilities

- Check tool customization settings aren't filtering all tools

- Verify connector successfully connects to Stripe API

- Review connector logs for tool registration errors

- Ensure Stripe account has access to requested features

Performance and rate limiting

Issue: Slow Response Times from Stripe Tools

Symptoms: Timeouts, delayed responses, users report sluggish performance

Solutions:

- Check Stripe API status for platform issues

- Review request patterns for inefficient operations

- Implement caching for frequently accessed data

- Optimize tool calls to reduce API round trips

- Consider geographic proximity of MintMCP infrastructure

Issue: Stripe API Rate Limits Exceeded

Symptoms: 429 errors, rate limit messages in logs, operations fail intermittently

Solutions:

- Monitor API usage in Stripe Dashboard

- Implement request throttling at gateway level

- Distribute load across multiple restricted API keys

- Cache customer and product data where appropriate

- Review tool usage patterns to identify excessive requests

Financial data issues

Issue: Payment Operations Not Reflected in Stripe Dashboard

Symptoms: Tools report success but changes don't appear, data inconsistencies

Solutions:

- Verify operations target correct Stripe account (live vs test mode)

- Check API key has write permissions for affected resources

- Review idempotency keys for duplicate request handling

- Confirm network connectivity between MintMCP and Stripe

- Investigate webhook failures for asynchronous operations

Issue: Incorrect Financial Calculations

Symptoms: Wrong refund amounts, incorrect proration, billing discrepancies

Solutions:

- Review tool arguments for currency and amount precision

- Verify timezone handling for subscription billing cycles

- Check proration behavior settings in Stripe account

- Test calculations with small values before production use

- Implement approval workflows for high-value operations

Why MintMCP provides superior Stripe MCP integration

While Stripe's official MCP server provides the protocol implementation, MintMCP delivers the enterprise infrastructure required for secure, compliant production deployments.

One-Click deployment with managed infrastructure

Unlike manual local installations, MintMCP provides instant STDIO-based MCP deployment with automatic OAuth protection. Finance teams deploy Stripe MCP connectors in minutes instead of days, without managing container orchestration, load balancing, or high availability infrastructure.

Unified governance across all AI tools

MintMCP's Virtual MCP architecture bundles multiple connectors into manageable endpoints, eliminating complexity of individual tool management. Monitor every AI tool interaction across Claude, ChatGPT, Cursor, and custom agents from a single interface with complete visibility into payment operations.

Enterprise security and compliance

Pre-built SOC2 Type II certification with complete audit trails for financial and regulatory compliance requirements. MintMCP provides SAML and OIDC authentication with existing identity providers, eliminating need to build custom compliance infrastructure.

Real-Time security controls

Block dangerous payment operations and protect sensitive customer data instantly through the LLM proxy layer. Create security rules at the gateway level that apply consistently across all Virtual MCP servers, preventing financial incidents before they occur.

For finance teams serious about AI-powered automation, MintMCP transforms Stripe MCP from experimental technology into production-ready infrastructure with enterprise security, compliance, and governance built in.

Frequently asked questions

What's the difference between using stripe's remote MCP server directly and connecting to IT through MintMCP?

Stripe's remote MCP server at https://mcp.stripe.com runs natively on Stripe's infrastructure, providing a quick and straightforward setup ideal for individual developers or small projects. However, it operates in isolation and does not include enterprise-grade governance features.

By contrast, when you connect to Stripe's MCP server through the MintMCP gateway, you retain the same underlying MCP capabilities while gaining MintMCP's governance and compliance layer. This includes centralized authentication (OAuth 2.0, SSO), fine-grained access controls, workspace-level visibility, policy enforcement, and full audit trails of every payment operation.

Can Stripe MCP access sensitive payment card data?

No. Stripe MCP servers interact with tokenized payment data and customer objects, not raw payment card information. Stripe maintains PCI Level 1 Service Provider certification and handles all sensitive card data processing. The MCP server accesses customer profiles, subscription details, invoice data, and transaction metadata—none of which include raw card numbers or CVV codes.

Organizations using Stripe MCP remain responsible for PCI compliance based on their integration method. Most implementations qualify for Self-Assessment Questionnaire A (SAQ A) when using Stripe's hosted payment forms and never touching card data directly.

How do we prevent AI agents from accidentally processing incorrect refunds?

Implement multiple layers of protection through MintMCP's security controls. First, create separate Virtual MCP servers for different teams with curated tool collections that exclude refund capabilities for most users. Only finance administrators should have Virtual MCP access with refund tools.

Second, configure LLM proxy rules that block refund operations exceeding specific amounts by matching tool names and arguments. Third, use Stripe's restricted API keys to limit refund permissions at the API level, preventing any operations outside configured bounds. Finally, implement approval workflows where high-value refunds require human confirmation before execution.

What's the recommended way to handle Stripe API rate limits for high-volume AI agent usage?

Stripe provides rate limits based on account history and processing volume. For most accounts, the limit is approximately 100 read requests and 100 write requests per second. Monitor your actual rate limits in the Stripe Dashboard under Developers → API requests.

Implement request throttling through MintMCP to prevent bursts that exhaust rate limits. Configure multiple restricted API keys for different Virtual MCP servers to distribute load. Cache customer data, product catalogs, and subscription details that change infrequently. Use batch operations where Stripe supports them to reduce request counts.

For extremely high-volume scenarios, contact Stripe to discuss rate limit increases based on your business needs. Monitor rate limit consumption through the MintMCP activity log and set up alerts when approaching 80% utilization.

How does MintMCP handle compliance requirements like SOC2 and PCI DSS for Stripe integrations?

MintMCP provides SOC2 Type II certification out of the box, eliminating the need to build custom compliance infrastructure. The platform automatically generates comprehensive audit trails showing who accessed which payment data, what operations they performed, and when each action occurred.

For PCI DSS compliance, MintMCP never handles raw payment card data. All payment processing occurs through Stripe's PCI-certified infrastructure. Organizations must complete appropriate Self-Assessment Questionnaires based on their Stripe integration method, typically SAQ A for hosted payment forms.

The audit and observability features generate compliance reports demonstrating policy enforcement, access controls, and security incident handling required for financial audits across all regulatory frameworks.