Financial services companies face a critical challenge: AI adoption is accelerating rapidly, yet data integration remains the top implementation barrier. The Model Context Protocol (MCP) provides a standardized way for AI systems to securely connect with financial data sources, compliance tools, and customer systems—but deploying MCP servers at scale requires enterprise infrastructure. MintMCP Gateway transforms local MCP servers into production-ready services with OAuth protection, real-time monitoring, and SOC2 Type II-aligned governance, enabling fintech brands to deploy AI integrations in days rather than months.

Key takeaways

- Production-ready with MintMCP: MCP standardizes how AI connects to fintech data; MintMCP Gateway hardens local MCP servers with OAuth/SSO, monitoring, HA, and full audit trails for enterprise use.

- Customer support & advisory, but governed: Assistants can securely pull CRM, transactions, and history to personalize answers while enforcing RBAC, least-privilege tools, and complete logging.

- NL analytics on Snowflake: Snowflake MCP (Cortex Analyst, semantic views, direct SQL) lets finance and product teams ask plain-language questions and get instant reports—no SQL tickets.

- Fraud & compliance via Elasticsearch MCP: ES tools power real-time anomaly detection, log forensics, and automated alerts with auditability for SOC 2/GDPR/PCI/BSA programs.

- Developer/agent governance: An LLM Proxy tracks every MCP tool call, bash command, and file read; it blocks secrets/dangerous ops and turns shadow AI into sanctioned, policy-controlled usage.

- Deploy & scale faster: One-click hosting of STDIO servers, centralized monitoring, failover, and (described) multi-region strategies help teams ship governed AI integrations. Teams can move much faster once identity, RBAC, and logging baselines are in place; timelines vary by environment.

Compliance note (copy-safe): MCP is a protocol, not a certification. Using MCP or a gateway does not by itself satisfy SOC 2, PCI-DSS, GDPR, BSA/AML, or HIPAA. Outcomes depend on your identity model (OAuth/SAML), RBAC, logging, data residency, vendor BAAs, and your validation package. Verify claims (e.g., SOC 2 Type II) with current audit reports and contracts before publishing or relying on them.

1. Enterprise-Grade customer support and personalized financial advisory

Financial institutions using AI-powered customer service can significantly reduce operational costs, but only when AI assistants can access real customer data securely. MCP enables AI chatbots to connect with CRM systems, transaction histories, and support documentation while maintaining strict access controls and audit trails.

What makes MCP different

Traditional customer service AI operates in isolation, forcing customers to repeat information and preventing personalized assistance. MCP-connected AI assistants access complete customer context—account balances, recent transactions, product holdings, and previous support interactions—delivering the personalized service that modern banking customers expect from AI-powered tools.

Comprehensive financial advisory

Modern customers expect personalized financial advice based on their complete financial picture. MCP enables AI financial advisors to securely access data across multiple financial institutions, investment accounts, and transaction histories:

- Banking data through secure APIs for transaction history and account balances

- Investment accounts for portfolio composition, performance, and asset allocation

- Credit reports for creditworthiness assessment and score improvement recommendations

- Bill payment history for cash flow analysis and optimization

AI advisors with comprehensive data access can analyze spending patterns across all accounts, optimize cash allocation between checking and investment accounts, provide tax-loss harvesting recommendations, and generate retirement planning scenarios using actual income and spending data.

Implementation with MintMCP

The MCP Gateway wraps your CRM APIs and core banking systems with OAuth 2.0 authentication, transforming them into secure MCP servers. Your AI assistants connect through Gmail MCP Server for email communications and custom MCP servers for account data—all with centralized governance and complete audit logs.

Customer Support Benefits:

- 24/7 availability with context-aware responses

- Improved customer engagement when recommendations are personalized

- Faster resolution times through immediate account access

- Consistent service quality across all channels

- Complete audit trails for compliance and quality monitoring

Security Features:

- Role-based access control for sensitive account data

- OAuth + SSO enforcement for every AI interaction

- Real-time monitoring of data access patterns

- Automatic blocking of unauthorized requests

- SOC2 Type II-aligned infrastructure

Getting Started: Deploy your first customer support MCP server with MintMCP's quickstart guide and connect AI assistants to production CRM systems quickly, often within hours, depending on the environment.

2. Real-Time financial reporting and product analytics through snowflake

Finance teams traditionally wait days for custom reports, but real-time data access enables better decision-making. MCP-connected AI agents enable executives and finance professionals to query data warehouses using natural language, generating instant reports without SQL expertise.

Snowflake MCP for natural language analytics

The Snowflake MCP Server transforms how finance teams interact with data warehouses. Instead of submitting SQL requests to engineering teams, executives ask questions in plain language: "What's our revenue variance by region this quarter?" or "Show me customer acquisition costs trending over the past six months."

Advanced Query Capabilities:

- Cortex Analyst for natural language to SQL conversion with semantic models

- Cortex Agent combines structured and unstructured data querying

- Semantic views enabling dimensions, metrics, and fact queries with filtering

- Direct SQL execution for power users with DML and DDL support

- Direct SQL execution (read-only by default; write operations are deployment-specific and generally disabled in governed environments).

Product analytics use cases

Product teams at consumer fintech apps need to understand user behavior, feature adoption, and engagement patterns. The Snowflake MCP Server enables product teams to query user behavior data through AI assistants:

- Cohort analysis tracking user behavior patterns over time

- Funnel queries identifying drop-off points in user journeys

- Feature adoption tracking measures engagement with new capabilities

- Instant answers to product questions without waiting for the data team support

- Faster identification of product-market fit signals

MintMCP gateway governance

Financial data requires strict access controls. MintMCP Gateway provides:

- Per-user authentication to track exactly who accessed what data

- Granular tool access control (enable read-only operations, exclude write tools)

- Complete audit trail of every query and data access

- High availability with automatic failover for critical reporting

Business Impact:

- Finance teams generate reports instantly instead of waiting for engineering

- Reduced compliance costs through automated reporting

- Executive teams access real-time KPIs without SQL knowledge

- Reduced data warehouse costs through optimized query patterns

Implementation Path: Connect your Snowflake instance to MintMCP Gateway, configure semantic models for your financial metrics, and enable AI assistants for executive teams—production-ready in days, not months.

3. Automated fraud detection and compliance monitoring

Financial services AI fraud detection systems can identify suspicious transactions faster than traditional methods, but only when they can search across comprehensive transaction logs and behavioral data. Elasticsearch MCP servers enable AI agents to perform semantic searches across millions of log entries, identifying fraud patterns in real-time.

How elasticsearch MCP transforms fraud prevention

The Elasticsearch MCP Server provides AI agents with five specialized tools for fraud detection and log analysis:

- search – Perform flexible document retrieval using Elasticsearch query DSL

- esql – Execute advanced ES|QL queries for pattern analysis

- list_indices – Discover all available data sources in your cluster

- get_mappings – Understand field structures for precise queries

- get_shards – Monitor cluster health and data distribution

Real-Time fraud detection use cases

AI agents connected to Elasticsearch can:

- Identify transaction anomalies by comparing current activity against historical patterns

- Cross-reference suspicious accounts against fraud databases

- Detect emerging fraud schemes through semantic pattern matching

- Generate real-time alerts when multiple fraud indicators align

- Automate investigation workflows by gathering relevant logs instantly

Compliance and audit trail requirements

Financial services companies cite security and compliance as primary concerns for AI data access. Financial services operate under strict regulatory frameworks requiring complete documentation of data access, user permissions, and system changes.

Why compliance matters for MCP deployments

Financial institutions implementing AI must comply with:

- SOC2 Type II requirements for data security and availability

- GDPR Article 22 for automated decision-making transparency

- PCI DSS for payment data access

- Bank Secrecy Act for transaction monitoring and reporting

Each regulation demands detailed audit trails showing who accessed what data, when, and for what purpose.

MintMCP gateway compliance features

Unlike local MCP deployments that operate as black boxes, MintMCP Gateway provides:

- Complete audit logs of every MCP interaction, access request, and configuration change

- OAuth 2.0 and SAML integration with your existing identity provider

- SOC2 Type II-aligned controls with rigorous security standards

- GDPR-compliant audit trails with data deletion and portability support

- Road-mapped / Vendor-dependent; confirm before claiming

Automated compliance monitoring

Financial institutions using AI for compliance automation report reduced compliance costs and faster regulatory report generation. MintMCP enables AI agents to:

- Access regulatory databases and transaction records through governed MCP servers

- Generate compliance reports automatically with complete audit trails

- Flag potential compliance issues before they become violations

- Maintain documentation for regulatory examinations

Production deployment

Enterprise fraud detection requires high availability and failover. MintMCP Gateway transforms your Elasticsearch cluster into an enterprise MCP service with automatic failover and SLA guarantees.

Meeting Regulatory Requirements: Learn how to configure Okta SAML SSO with MintMCP Gateway for enterprise authentication and complete audit trail coverage.

4. Secure coding agent monitoring and shadow AI governance

Financial services development teams increasingly use AI coding assistants like Cursor and Claude Code, but these agents operate with extensive system access—reading files, executing commands, and accessing production systems through MCP tools. Without monitoring, organizations cannot see what agents access or control their actions.

The coding agent security challenge

AI coding assistants can:

- Read sensitive files, including

.envconfiguration and SSH keys - Execute bash commands with developer permissions

- Access production databases through the MCP tool connections

- Modify critical infrastructure code

- Install and use MCP servers without oversight

For fintech companies handling sensitive financial data, this creates significant security and compliance risks.

LLM proxy solution

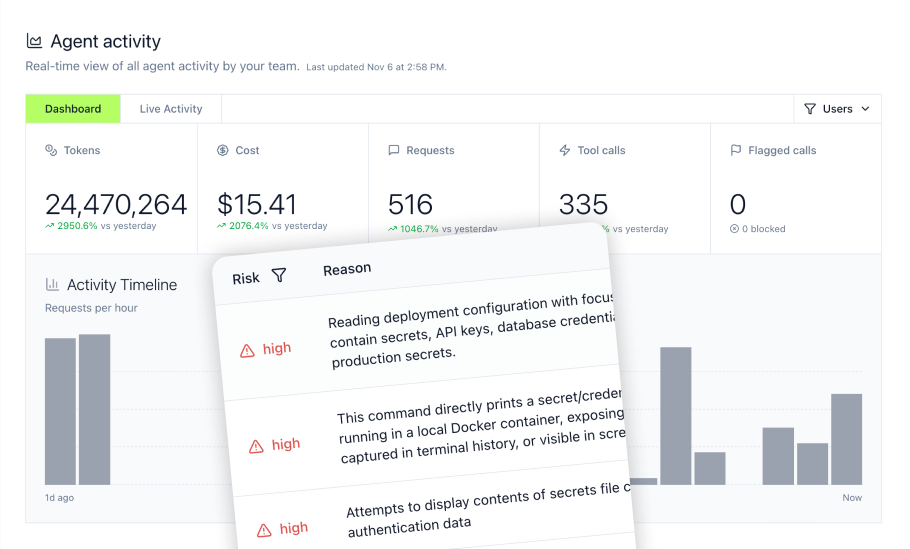

The MintMCP LLM Proxy sits between your LLM client (Cursor, Claude Code) and the model itself, providing complete visibility and control:

Tool Call Tracking:

- Monitor every MCP tool invocation across all coding agents

- Track every bash command executed during development

- See which files agents access in real-time

- Complete inventory of installed MCPs and their permissions

Security Guardrails:

- Block dangerous commands like reading environment secrets or executing risky operations

- Protect sensitive files from unauthorized access (.env files, credentials, SSH keys)

- Control MCP permissions in real-time based on security policies

- Complete audit trail of all operations for security review

Shadow AI governance

Without centralized governance, fintech organizations face:

- Zero visibility into which AI tools employees use

- No audit trails of what data AI tools access

- Uncontrolled costs as teams purchase individual subscriptions

- Compliance gaps when AI accesses regulated financial data

- Security risks from unapproved integrations with sensitive systems

- Data leakage when employees paste confidential information into public AI tools

MintMCP's governance framework

Transform shadow AI into sanctioned AI without slowing developers:

Centralized AI Tool Access:

- Self-service MCP access allowing developers to request and receive approved AI tool connections instantly

- Pre-configured policies ensuring all AI tools meet security and compliance standards

- Curated tool sets through Virtual MCPs, exposing the minimum required capabilities

- Centralized credentials managing all AI tool API keys and tokens in one place

Complete Visibility:

- Real-time usage tracking monitoring every AI tool interaction across Claude Code, Cursor, ChatGPT, and more

- Cost analytics tracking spending per team, project, and tool with detailed breakdowns

- Performance metrics measuring response times, error rates, and usage patterns

- Data access logs showing exactly what data each AI tool accesses and when

Enterprise Features:

- High availability with enterprise SLAs and self-hosted options

- MCP inventory showing all installed MCPs across your development team

- Usage analytics tracking, which tools developers use most frequently

- Real-time alerts when security policies are violated

Deployment: Set up LLM Proxy for Cursor to monitor and control coding agent behavior across your fintech development team.

5. One-Click MCP deployment

Payment processors and financial infrastructure providers face a critical challenge: most MCP servers are STDIO-based and difficult to deploy in production environments. Financial services require enterprise-grade hosting with authentication, monitoring, and high availability.

The STDIO MCP deployment problem

Many open-source, STDIO-based MCP servers are designed for local development and may lack:

- Built-in authentication or OAuth support

- Enterprise server management and lifecycle monitoring

- Horizontal scaling capabilities for production load

- Audit logging and security controls

- Deployment infrastructure and automation

Financial services companies cannot deploy these local utilities into production systems handling real customer data and payment processing.

MintMCP gateway solution

MCP Gateway transforms STDIO MCP servers into production-ready services:

One-Click Deployment:

- Host STDIO servers on MintMCP instead of running locally—containerized servers become accessible to clients without local installations

- Automatic OAuth wrapping adds enterprise authentication to any MCP server instantly

- Built-in monitoring tracks server health, usage patterns, and performance metrics

- Lifecycle management handles server updates, restarts, and scaling automatically

Enterprise Hardening:

- High availability with automatic failover and redundancy

- OAuth + SSO enforcement for every MCP connection

- Real-time monitoring dashboards for server health and usage

- Complete audit logs for every tool invocation and data access

Financial data access

Global fintech companies face complex data sovereignty requirements as they expand across jurisdictions. Financial services operating internationally must navigate:

- GDPR requirements in Europe require EU data residency

- Financial data localization laws in countries like Russia, China, and India

- Cross-border transfer restrictions for personally identifiable information

- Regional compliance frameworks with varying security and audit requirements

- Performance optimization through geographic distribution

Critical considerations for FinTech MCP deployment

Security Cannot Be an Afterthought: Financial services companies cite security and compliance as primary AI concerns. MCP deployments without proper authentication, audit logging, and access controls create regulatory risks that can result in significant penalties. Deploy MCP servers through MintMCP Gateway to get SOC2 Type II-aligned controls, OAuth protection, and complete audit trails from day one.

Start with High-Value Use Cases: Begin with customer support, fraud detection, or compliance automation where AI delivers measurable benefits, then expand to additional use cases once governance frameworks are proven.

Governance Enables Speed: The paradox of AI governance is that proper controls actually accelerate deployment. With centralized authentication, pre-configured security policies, and self-service access through MintMCP, developers deploy new AI integrations quickly instead of waiting weeks for security review of custom implementations.

Compliance Is Continuous: Meeting regulatory requirements isn't a one-time implementation task. Financial services regulations evolve constantly, requiring ongoing monitoring, audit trail maintenance, and policy updates. Choose an MCP infrastructure that provides continuous compliance monitoring rather than point-in-time certification.

Frequently asked questions

Q: How quickly can FinTech companies deploy MCP servers with enterprise security?

A: With MintMCP Gateway, you can deploy STDIO-based MCP servers with OAuth protection, monitoring, and audit logging quickly, often within hours, depending on your environment. Traditional custom integrations for financial systems take months—MintMCP transforms local MCP utilities into production services through one-click deployment and automatic security wrapping.

Q: What compliance certifications does MintMCP provide for financial services?

A: MintMCP Gateway maintains SOC2 Type II-aligned controls available for health-related financial products. The platform provides complete audit trails for GDPR compliance, supports OAuth 2.0 and SAML authentication. Every MCP interaction, access request, and configuration change is logged for regulatory examination.

Q: Can MintMCP prevent coding agents from accessing sensitive credentials?

A: Yes, the LLM Proxy monitors every MCP tool invocation and bash command from coding agents like Cursor and Claude Code, blocking access to .env files, SSH keys, and other sensitive credentials in real-time. You get complete visibility into which files agents access, which commands they execute, and which MCPs they install—with automated blocking of risky operations before they execute.