Choosing the right MCP gateway can determine whether your fintech startup scales securely or faces regulatory roadblocks. With 86% of enterprises requiring tech stack upgrades to deploy AI agents properly, and 62% of leaders citing compliance concerns as their top barrier, the stakes have never been higher.

Model Context Protocol (MCP) has emerged as the industry standard for connecting AI agents to financial systems—backed by Anthropic, OpenAI, Google, and Microsoft. An MCP gateway provides the deployment infrastructure, security controls, and governance features that transform local MCP servers into production-ready services.

For fintech startups, this means connecting AI assistants to payment processing systems, fraud detection databases, and customer support platforms while maintaining the compliance posture that investors and regulators demand. We analyzed 15+ MCP gateway solutions across security compliance, performance benchmarks, fintech-specific integrations, and startup pricing models to identify the 10 best options for fintech startups in 2026.

Key Takeaways

- Compliance is non-negotiable: Fintech startups require SOC 2 Type II certification, audit trails, and OAuth 2.0 authentication to meet GLBA, PCI-DSS, and GDPR requirements

- Performance matters for real-time applications: Trading platforms and fraud detection systems need sub-5ms latency—some gateways add as little as 11 microseconds overhead

- Integration breadth accelerates time-to-market: Pre-built connectors for financial APIs can reduce development from months to weeks

- Security-first gateways protect sensitive data: Real-time threat detection, PII masking, and credential vaults prevent catastrophic data breaches

- Open-source options preserve cash runway: Bootstrap startups can deploy production-ready MCP infrastructure at zero licensing cost

1. MintMCP Gateway – SOC 2 Certified with One-Click Deployment

MintMCP Gateway has set the standard for enterprise-grade MCP infrastructure with SOC 2 Type II–audited controls for its MCP gateway and agent governance stack. For fintech startups preparing for Series A fundraising or working with enterprise clients, this certification eliminates weeks of security questionnaire responses.

What Makes MintMCP Different

MintMCP transforms local STDIO-based MCP servers into production services in minutes rather than weeks. The platform automatically wraps any MCP server with OAuth 2.0 authentication, eliminating the manual configuration that typically delays fintech deployments. Pre-built connectors for Snowflake and Elasticsearch enable immediate integration with financial data warehouses and search infrastructure.

Key Features for Financial Applications

- SOC 2 Type II certification: Speeds investor due diligence and satisfies enterprise client security requirements

- Complete audit trails: Meets GDPR and GLBA compliance requirements with immutable logging

- Role-based virtual MCP servers: Expose only curated tool sets to specific teams—critical for separation of duties in financial operations

- Real-time monitoring: Track every MCP tool interaction with dashboards for usage patterns and security alerts

Fintech Use Cases

- Fraud detection: Connect AI agents to Elasticsearch for real-time transaction monitoring

- Financial reporting: Automate variance analysis through Snowflake integration

- Compliance automation: Achieve 50-70% reduction in false positives with AI-powered compliance workflows

Best For: Fintech startups requiring rapid enterprise deployment with compliance from day one

Getting Started: Visit mintmcp.com to book a demo

2. Composio

Composio accelerates fintech development by providing an extensive library of managed MCP integrations. For startups prioritizing time-to-market, the platform's 500+ pre-built connectors eliminate months of custom integration work.

How Composio Fits Fintech Teams

The platform handles authentication complexity automatically—OAuth flows, API key management, and token refresh cycles that typically consume engineering bandwidth. Every integration is maintained and updated by Composio's team, removing ongoing maintenance burden from lean startup teams.

Key Features for Financial Applications

- Unified authentication layer: Automatic OAuth and API key management across all financial API integrations

- Production-grade RBAC: Role-based access control with PII protection built-in

- Low latency performance: Optimized for real-time financial data processing

- Zero-maintenance integrations: Composio team handles all connector updates and breaking changes

Best For: Fintech startups needing rapid integration with payment gateways, accounting software, CRM platforms, and banking APIs without building custom connectors

3. Lasso Security

Lasso Security addresses MCP's security challenges with a gateway built specifically for threat detection and data protection. Named a Gartner Cool Vendor in AI Security 2024, the platform provides fintech startups with enterprise-grade protection for customer PII and financial records.

Lasso’s Security Focus

The platform implements a triple-gate security pattern that protects AI, MCP, and API layers simultaneously. Real-time detection blocks prompt injection attacks, credential theft attempts, and tool poisoning before they reach production systems.

Key Features for Financial Applications

- Real-time prompt injection blocking: Prevents malicious inputs from compromising financial systems

- PII masking: Automatic detection and redaction of sensitive customer data in MCP traffic

- Tool reputation analysis: Risk scoring for community MCP servers before integration

- Plugin architecture: Extensible security scanning for custom compliance requirements

Performance Trade-off: 100-250ms latency overhead due to comprehensive security scanning—acceptable for most fintech applications except high-frequency trading

Best For: Fintech startups handling customer PII, payment credentials, or regulated financial data requiring real-time threat detection

4. TrueFoundry MCP Gateway

TrueFoundry emphasizes performance, citing sub-10ms latency and 350+ requests per second on a single vCPU in published benchmarks. For fintech startups building algorithmic trading platforms or real-time fraud detection, this performance advantage translates directly to competitive edge.

TrueFoundry’s Performance Angle

The platform provides a unified control plane for both LLM calls and MCP tool invocations, simplifying infrastructure management for AI-heavy fintech applications. OAuth 2.0 Identity Injection enables On-Behalf-Of authentication without custom integration work.

Key Features for Financial Applications

- Low-latency design: benchmarked for high-throughput, latency-sensitive workloads

- Unified AI stack: Manage LLM and MCP infrastructure from single platform

- SOC 2 compliance: Enterprise certifications achieved in 2024

- OAuth 2.0 Identity Injection: Seamless authentication for financial API integrations

Best For: Fintech startups building high-frequency trading tools, real-time fraud detection systems, or latency-sensitive payment processing where milliseconds impact revenue

5. Bifrost by Maxim AI

Bifrost is optimized for extremely low overhead in published benchmarks: 11 microseconds of overhead in sustained 5,000 RPS benchmarks (per published results), with a Go-based architecture optimized for throughput. The open-source Go-based architecture provides consistent performance under load without licensing costs.

Bifrost’s Architecture Approach

Native compilation and zero-config deployment enable fintech startups to achieve enterprise performance on bootstrap budgets. Semantic caching reduces AI costs up to 40%, preserving runway while scaling.

Key Features for Financial Applications

- Industry-leading latency: 11µs overhead enables microsecond-sensitive trading applications

- 40% cost reduction: Semantic caching eliminates redundant API calls

- 15+ provider support: OpenAI, Anthropic, AWS Bedrock, Google Vertex integration

- Zero licensing cost: MIT open-source license with enterprise managed options

Best For: Fintech startups building algorithmic trading systems, real-time risk assessment, or high-frequency customer interactions where performance and cost efficiency are paramount

6. Portkey

Portkey provides comprehensive compliance coverage with SOC 2, ISO 27001, HIPAA, and GDPR certifications—ideal for fintech startups operating across multiple regulatory jurisdictions. The platform's 50+ pre-built guardrails accelerate security implementation.

Portkey for Compliance Coverage

End-to-end LLMOps capabilities extend beyond gateway functionality to cover the entire AI lifecycle. Enterprise plans typically include reliability commitments and support options suitable for mission-critical applications.

Key Features for Financial Applications

- 50+ pre-built guardrails: PII detection, content filtering, and compliance controls

- Immutable audit trails: Complete logging for regulatory examination

- Multiple deployment options: SaaS, hybrid, and air-gapped environments

- Comprehensive compliance: SOC 2, ISO 27001, HIPAA, GDPR coverage

Best For: Fintech startups facing multiple regulatory requirements (EU operations requiring GDPR, healthcare-adjacent finance requiring HIPAA) who need comprehensive certification coverage

7. Prompt Security

Prompt Security addresses the supply chain risk of community-built MCP servers by analyzing over 13,000 MCP servers on GitHub with dynamic risk scoring. For fintech startups evaluating open-source tools, this assessment prevents integration of compromised components.

Prompt Security for MCP Risk Review

The platform's MCP Risk Assessment performs code-level inspection to identify vulnerabilities before integration. Endpoint-level monitoring discovers "shadow MCP" usage across the organization, ensuring compliance visibility. The security framework aligns with the OWASP Top 10 for comprehensive threat coverage.

Key Features for Financial Applications

- 13,000+ server analysis: Risk scoring for GitHub MCP ecosystem

- Shadow MCP discovery: Identify unauthorized tool usage organization-wide

- Real-time enforcement: Block dangerous operations automatically

- Code-level inspection: Vulnerability assessment before integration

Best For: Fintech startups evaluating community MCP servers who need security assessment before integration into production financial systems

8. Lunar.dev MCPX

Lunar.dev MCPX balances governance requirements with developer experience, achieving 4ms p99 latency while providing comprehensive cost and performance tracking. For fintech startups monitoring burn rate, the built-in analytics justify every AI dollar spent.

Lunar.dev MCPX for Cost + Observability

The platform supports both STDIO and remote HTTP/SSE MCP servers, enabling gradual migration from development to production environments. Full OpenTelemetry integration provides latency, token cost, and request tracing out of the box.

Key Features for Financial Applications

- Cost analytics: Track AI spending per team, project, and tool

- Performance monitoring: Latency, error rates, and usage pattern visibility

- Centralized RBAC: Granular tool-level permission management

- Hybrid deployment: Docker/Kubernetes with optional SaaS dashboards

Best For: Fintech startups transitioning from prototype to production who need observability into AI agent costs and performance

9. Docker MCP Gateway

Docker MCP Gateway extends Docker's proven container orchestration to MCP infrastructure, providing fintech startups with enterprise patterns at zero licensing cost. Teams already using Docker for microservices add MCP capabilities without learning new platforms.

Docker Gateway for Docker-Native Teams

The gateway uses familiar Docker Compose configurations, reducing learning curve for DevOps teams. Container isolation with signed images and Docker secret management provides security foundations without custom development. The platform helps mitigate vulnerabilities like CVE-2025-6514 through containerization.

Key Features for Financial Applications

- Container security: Isolation, signed images, and secret management

- CLI-driven workflow: docker mcp commands integrate with existing pipelines

- Zero licensing cost: Open-source MIT license

- DevOps familiarity: Docker Compose configurations developers already know

Performance note: overhead varies by deployment and server/container configuration; teams should benchmark in their own environment for latency-sensitive use cases.

Best For: Bootstrap fintech startups with Docker expertise and limited budgets who need production-grade MCP infrastructure without licensing costs

10. Kong AI Gateway

Kong AI Gateway extends the proven enterprise API management platform to MCP and AI traffic. Organizations with existing Kong infrastructure can unify API and MCP governance through Kong's extensive plugin ecosystem.

Kong in Existing API Environments

Kong's plugin-based architecture applies decades of API security expertise to MCP challenges. OpenID Connect, Key Auth, and rate limiting plugins provide flexible security configurations, while OpenTelemetry integration enables comprehensive observability.

Key Features for Financial Applications

- Plugin-based security: OpenID Connect, Key Auth, rate limiting

- MCP proxy support: Expose governed APIs as MCP tools

- Unified governance: Single platform for APIs and AI/MCP traffic

- OpenTelemetry observability: Comprehensive monitoring and tracing

Best For: Organizations with existing Kong infrastructure seeking unified API and MCP management

Making Your Choice: Essential Considerations for Fintech Startups

Selecting the right MCP gateway requires balancing compliance requirements, performance needs, integration breadth, and budget constraints. For most fintech startups, MintMCP Gateway provides the optimal combination of enterprise-grade security, rapid deployment, and compliance certifications that accelerate both investor due diligence and customer acquisition.

Compliance Requirements Determine Your Starting Point

Financial services face regulatory requirements that general-purpose software doesn't. GLBA mandates protection of customer financial data. PCI-DSS governs payment credential handling. FFIEC guidelines require risk-based authentication for banking applications. SOC 2 Type II certification—available from MintMCP and select enterprise gateways—significantly accelerates compliance verification for investor due diligence and enterprise sales.

Match Gateway Choice to Company Stage

Pre-seed and bootstrap startups often prioritize zero licensing costs with solutions like Docker Gateway or Bifrost. Seed-stage companies balance features and cost with platforms offering rapid development capabilities. Series A and beyond typically require compliance certifications and enterprise SLAs that only certified gateways like MintMCP provide.

Performance Requirements Vary by Use Case

Real-time trading applications require sub-5ms latency—only TrueFoundry (3-4ms) and Bifrost (11µs) meet this threshold. Customer support automation tolerates higher latency in exchange for comprehensive security scanning. Financial reporting workflows prioritize integration breadth over raw speed.

Security Philosophy Impacts Architecture

Some gateways prioritize threat detection, while others focus on credential protection or compliance governance. MintMCP emphasizes complete audit trails and role-based access control—essential for fintech compliance. Consider your primary risk: Are you most concerned about prompt injection attacks, credential leaks, or audit trail completeness? The answer guides gateway selection.

Conclusion: Deploy Enterprise AI with Confidence

The Model Context Protocol has fundamentally changed how fintech startups connect AI assistants to payment systems, customer databases, and compliance tools. But as this analysis demonstrates, deploying MCP at scale requires more than just protocol support—it demands enterprise-grade security, governance, and monitoring that transforms experimental AI into production-ready infrastructure.

MintMCP Gateway stands out as the fastest path from pilot to production for fintech startups. With SOC 2 Type II certification, one-click deployment that eliminates weeks of configuration work, and pre-built connectors for Snowflake and Elasticsearch, MintMCP removes the technical and compliance barriers that keep organizations stuck in AI pilot purgatory.

Whether you're securing access to financial data warehouses, fraud detection systems, or customer support platforms, MintMCP provides the infrastructure that makes AI deployment practical, compliant, and secure. The platform's role-based virtual MCP servers ensure separation of duties, while comprehensive audit logging satisfies the most demanding regulatory requirements.

For fintech startups, the choice is clear: invest engineering resources in building your core product, not in configuring authentication systems and building compliance infrastructure. MintMCP delivers enterprise-grade MCP capabilities from day one, accelerating your path to market while maintaining the security posture that investors and regulators demand.

Ready to transform your AI infrastructure? Visit mintmcp.com to schedule a demo and see how MintMCP Gateway can accelerate your fintech startup's AI deployment.

Frequently Asked Questions

What is the primary benefit of an MCP gateway for a fintech startup?

An MCP gateway transforms local MCP servers into production-ready services with enterprise authentication, audit trails, and monitoring. For fintech startups, this means connecting AI agents to payment systems, customer databases, and compliance tools while maintaining the security posture that regulators and investors require. Without a gateway, fintech startups face manual OAuth configuration, scattered credentials, and no audit visibility—all compliance red flags.

How do MCP gateways ensure compliance with financial regulations like SOC 2 or GDPR?

Enterprise-grade MCP gateways like MintMCP provide complete audit trails logging every tool call, data access, and user action. SOC 2 Type II certification verifies that security controls operate effectively over time. GDPR compliance requires audit logs demonstrating data access patterns—features built into managed gateways but requiring custom development for open-source options.

Can an MCP gateway help reduce costs associated with AI tool usage in a fintech company?

Yes—through multiple mechanisms. Semantic caching can reduce costs up to 40% by eliminating redundant API calls. Cost analytics identify expensive tool patterns for optimization. Governance controls prevent unauthorized usage that inflates bills. Pre-built integrations reduce development costs by eliminating months of custom integration work that would otherwise consume engineering resources.

What AI clients are compatible with MCP gateway technology?

MCP gateways support Claude (Desktop and Web), ChatGPT (via Custom GPTs and Actions), Microsoft Copilot, Cursor, Gemini, Goose, LibreChat, Open WebUI, Windsurf, and custom MCP-compatible agents. This broad compatibility ensures fintech startups can standardize on one gateway while supporting diverse AI tools across engineering, customer support, and operations teams.

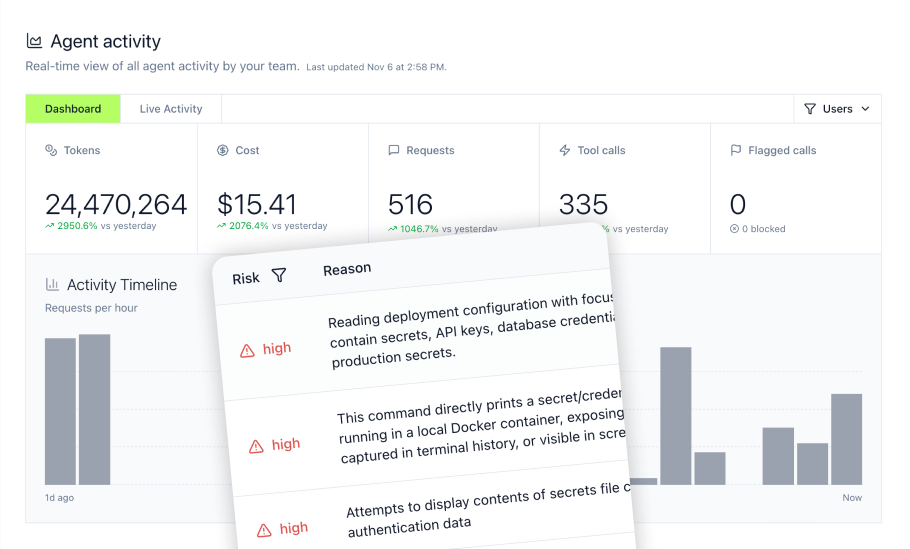

How does an LLM Proxy enhance security for coding agents in a fintech environment?

An LLM Proxy monitors every tool call, bash command, and file operation from coding agents like Cursor or Claude Code. For fintech environments, this means blocking access to .env files containing API keys, preventing dangerous shell commands, and maintaining audit trails of every agent action. Without proxy monitoring, coding agents operate as black boxes with zero telemetry and uncontrolled access—significant security risks when handling financial code.