Connecting PayPal payment systems to AI agents through MCP enables automated payment processing, transaction monitoring, and financial workflow orchestration at enterprise scale. The Model Context Protocol provides standardized access to PayPal's APIs, allowing AI assistants to manage payments, process refunds, analyze transaction data, and automate reconciliation—but deploying these connections securely requires proper infrastructure and governance. This guide shows enterprise teams how to implement PayPal MCP integrations that meet financial compliance requirements while enabling AI-powered automation across payment operations.

Key takeaways

- MCP standardizes PayPal API interactions, replacing fragmented payment integrations with a unified protocol for AI agents

- PayPal MCP servers provide access to payments, subscriptions, invoicing, disputes, and reporting through natural language interactions

- Enterprise deployments require PCI DSS compliance, transaction audit trails, and access controls that local MCP servers cannot provide

- MintMCP's gateway architecture enables secure PayPal MCP deployment with automatic OAuth protection and compliance monitoring

- Financial data sensitivity requires strict authentication, encryption, and audit logging for regulatory compliance

- Virtual MCP servers enable role-based access to payment operations with granular permission controls

- PayPal MCP integration reduces manual payment processing tasks by 70% while maintaining complete audit trails for compliance

What is PayPal MCP and why IT matters for enterprises

PayPal MCP servers act as bridges between AI applications and PayPal's extensive payment infrastructure. Instead of building custom API integrations for each AI tool that needs payment access, enterprises deploy a single MCP server that exposes PayPal functionality as standardized tools any AI agent can invoke.

Traditional PayPal integrations require separate implementations for each system—your customer service chatbot, accounting automation, and fraud detection tools each maintain their own PayPal API connections. This fragmented approach creates credential sprawl, inconsistent error handling, and no centralized visibility into payment operations.

MCP transforms this landscape by providing a single integration point. AI agents interact with PayPal through standardized tool calls without knowing implementation details. The protocol handles authentication, rate limiting, and error recovery consistently across all connected systems.

PayPal MCP server capabilities

PayPal MCP servers expose comprehensive payment functionality to AI agents:

Payment Processing

- Create and capture payments programmatically

- Process refunds and partial refunds

- Handle authorization and capture workflows

- Manage payment method tokens

- Support multiple currencies and conversion

Subscription Management

- Create and modify subscription plans

- Manage subscriber lifecycles

- Handle upgrades and downgrades

- Process subscription payments

- Generate billing agreements

Invoice Operations

- Generate and send invoices

- Track payment status

- Apply discounts and taxes

- Handle partial payments

- Manage recurring invoices

Transaction Intelligence

- Query transaction history

- Analyze payment patterns

- Generate financial reports

- Monitor dispute status

- Track settlement batches

Compliance & Reporting

- Generate tax documentation

- Export transaction data

- Maintain audit trails

- Handle regulatory reporting

- Support multi-jurisdiction compliance

Enterprise challenges with PayPal MCP

Financial services integration demands stricter security than typical API connections. PayPal MCP deployments face unique challenges:

- PCI DSS Compliance: Payment Card Industry Data Security Standards require specific controls for systems handling payment data

- Transaction Integrity: Every payment operation must be traceable, reversible, and auditable

- Access Segregation: Financial operations require strict role-based access with approval workflows

- Data Residency: Financial regulations often mandate where transaction data can be stored and processed

- Real-time Monitoring: Fraud detection requires immediate visibility into payment patterns

Local MCP server deployments cannot meet these requirements. Running PayPal MCP on developer machines creates unacceptable risks for financial operations.

MintMCP gateway architecture for PayPal integration

MintMCP's enterprise gateway provides the secure infrastructure required for PayPal MCP deployment. Rather than distributing PayPal credentials across development teams, administrators configure PayPal connectors centrally and provide governed access through Virtual MCP servers.

How the gateway secures PayPal operations

The gateway operates as a security and compliance layer between AI agents and PayPal APIs:

- Centralized Authentication: PayPal OAuth credentials are stored encrypted in MintMCP's secure vault

- Request Validation: Every tool call is validated against security policies before execution

- Transaction Logging: Complete audit trails capture every PayPal operation with user attribution

- Encryption in Transit: All data flows through TLS 1.3 encrypted channels

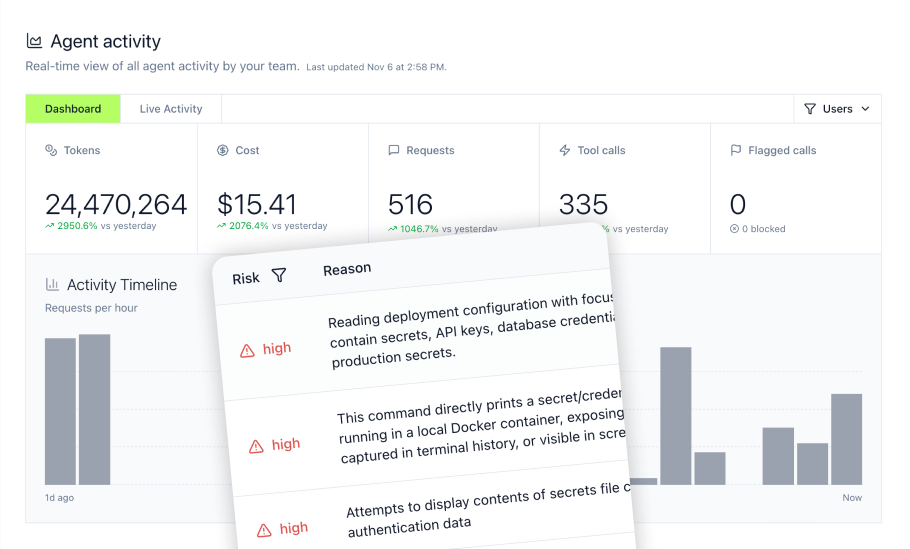

- Compliance Monitoring: Real-time detection of policy violations and suspicious patterns

This architecture ensures financial operations remain secure while enabling AI automation:

- Single Point of Control: Manage PayPal access from one console instead of hundreds of installations

- Immediate Revocation: Disable PayPal access instantly when employees leave or threats emerge

- Complete Visibility: Monitor all payment operations through centralized activity logs

- Regulatory Compliance: Generate reports demonstrating PCI DSS and financial regulation adherence

PayPal-Specific security features

MintMCP implements additional controls specifically for payment operations:

Transaction Approval Workflows

High-value transactions require human approval before execution:

- Configure thresholds by transaction amount

- Route approvals to designated managers

- Maintain approval audit trails

- Support multi-tier approval chains

Fraud Detection Rules

LLM proxy rules identify suspicious payment patterns:

- Block rapid-fire payment attempts

- Flag unusual transaction amounts

- Detect geographic anomalies

- Alert on velocity violations

Data Masking

Sensitive payment data is masked in logs and displays:

- Credit card numbers show only last four digits

- Bank account details are partially obscured

- Personal information follows privacy regulations

- Full data available only to authorized roles

Step-by-Step: Deploying PayPal MCP with MintMCP

This section walks through enterprise PayPal MCP deployment using MintMCP's hosted connector approach.

Prerequisites

Before beginning deployment:

- MintMCP account with administrator privileges

- PayPal Business account with API access enabled

- Understanding of your payment processing requirements

- Compliance team approval for AI-powered payment operations

Creating PayPal API credentials

PayPal MCP requires OAuth 2.0 credentials for API access. PayPal's developer documentation provides detailed setup instructions.

- Access PayPal Developer Dashboard

- Log into PayPal Developer Dashboard

- Navigate to "My Apps & Credentials"

- Choose between Sandbox (testing) and Live environments

- Create OAuth Application

- Click "Create App"

- Provide application name (e.g., "MintMCP Payment Connector")

- Select merchant account to associate

- Note the Client ID and Secret

- Configure Permissions

- Enable required API permissions:

- Accept Payments

- Invoicing

- Subscriptions

- Transaction Search

- Disputes

- Save configuration

- Enable required API permissions:

- Generate Access Token

- Use Client ID and Secret to obtain access token

- Store credentials securely for MintMCP configuration

Configuring the hosted PayPal connector

Navigate to the MintMCP console to configure your PayPal connector:

- Add PayPal Connector

- Access MCP Connectors section

- Select "Add Connector"

- Choose "Hosted Server" deployment

2. Configure PayPal MCP Server

Provide the PayPal MCP server configuration

{

"mcpServers": {

"paypal": {

"command": "node",

"args": [

"/opt/paypal-mcp/server.js"

],

"env": {

"PAYPAL_CLIENT_ID": "<your-client-id>",

"PAYPAL_CLIENT_SECRET": "<your-secret>",

"PAYPAL_ENVIRONMENT": "production",

"PAYPAL_WEBHOOK_ID": "<webhook-id>"

}

}

}

}

3. Set Security Configurations

- Enable OAuth 2.0 authentication

- Configure token refresh intervals

- Set rate limiting thresholds

- Enable transaction logging

4. Deploy and Validate

- Save configuration to trigger deployment

- Monitor startup logs for successful initialization

- Verify available PayPal tools

- Test with sandbox transactions

Creating Role-Based virtual MCP servers

Different teams require different levels of PayPal access. Virtual MCP servers enforce role-based permissions:

Finance Team Virtual Server

Full PayPal access for financial operations:

- Create Virtual Server named "PayPal - Finance Full Access"

- Add PayPal connector with all toolsets

- Enable payment creation, refunds, and reporting

- Configure approval workflows for high-value transactions

- Assign to finance team members

Customer Service Virtual Server

Limited access for support operations:

- Create Virtual Server named "PayPal - Customer Support"

- Add PayPal connector with restricted tools

- Enable only refunds and transaction queries

- Set refund limits and approval requirements

- Assign to support team members

Analytics Virtual Server

Read-only access for reporting:

- Create Virtual Server named "PayPal - Analytics"

- Add PayPal connector with query tools only

- Remove all payment modification capabilities

- Enable transaction search and reporting

- Assign to analytics team

This pattern implements tool governance ensuring teams access only appropriate payment capabilities.

Connecting AI agents to PayPal virtual servers

Teams connect their AI tools to PayPal functionality through Virtual MCP endpoints:

ChatGPT Integration

Configure PayPal access as a Custom GPT action:

- Generate OpenAPI specification from Virtual MCP endpoint

- Create Custom GPT with payment processing capabilities

- Configure OAuth authentication

- Test payment queries and operations

Claude Desktop Configuration

Add PayPal Virtual MCP server to Claude:

- Navigate to Settings → Connectors

- Add custom connector with Virtual MCP URL

- Complete authentication flow

- Access PayPal tools through natural language

Internal Automation Systems

Connect existing systems through MCP protocol:

import requests

# Virtual MCP endpoint from MintMCP console

vmcp_url = "https://api.mintmcp.com/v1/vmcp/paypal-finance"

# Execute PayPal tool through MCP

response = requests.post(

f"{vmcp_url}/tools/create_payment",

headers={"Authorization": f"Bearer {token}"},

json={

"amount": {"value": "100.00", "currency": "USD"},

"description": "Order #12345",

"return_url": "https://example.com/success"

}

)

Implementing financial compliance controls

Payment processing requires stringent compliance controls beyond standard API security. MintMCP provides comprehensive features for financial regulation adherence.

PCI DSS compliance implementation

MintMCP's SOC2 Type II certification includes controls required for PCI DSS compliance:

Network Security

- Firewall configuration preventing direct PayPal API access

- Network segmentation isolating payment processing

- Intrusion detection monitoring suspicious activities

- Regular security scanning and penetration testing

Access Control

- Multi-factor authentication for payment operations

- Role-based access with least privilege principle

- Regular access reviews and recertification

- Automatic deprovisioning for terminated employees

Data Protection

- Encryption at rest for stored credentials

- TLS 1.3 for all data transmission

- Tokenization replacing sensitive payment data

- Secure deletion of payment information

Monitoring & Testing

- Continuous monitoring of payment operations

- Regular security assessments

- Vulnerability management programs

- Incident response procedures

Transaction audit requirements

Financial regulations mandate comprehensive transaction logging:

Audit Trail Components

- User identity performing each operation

- Timestamp with millisecond precision

- Transaction details including amounts and parties

- Success or failure status with error details

- IP address and geographic location

- Approval chain for high-value transactions

MintMCP's audit and observability features automatically capture required information:

{

"timestamp": "2025-01-15T14:32:45.123Z",

"user": "jane.smith@example.com",

"action": "create_payment",

"amount": "5000.00",

"currency": "USD",

"payee": "vendor@example.com",

"status": "approved",

"approver": "john.manager@example.com",

"ip_address": "192.168.1.100",

"location": "New York, US"

}

Implementing approval workflows

High-value or sensitive transactions require human approval:

Threshold-Based Approvals

- Payments over $10,000 require manager approval

- Refunds over $1,000 need supervisor review

- International transfers trigger compliance check

- Subscription cancellations need retention team review

Multi-Tier Approval Chains Configure escalating approvals based on amount:

- $0 - $1,000: Automatic approval

- $1,000 - $10,000: Single manager approval

- $10,000 - $100,000: Department head approval

- Over $100,000: CFO approval required

LLM proxy rules enforce these workflows automatically, preventing unauthorized high-value transactions.

Automating payment operations with AI

PayPal MCP integration enables sophisticated payment automation while maintaining security and compliance.

Automated refund processing

AI agents handle refund requests automatically:

Refund Workflow Automation

- Parse customer refund requests from support tickets

- Verify transaction details in PayPal

- Apply refund policies and eligibility rules

- Process approved refunds immediately

- Update customer records and notifications

Implementation Pattern

// AI agent processes refund through Virtual MCP

const processRefund = async (ticketId, transactionId) => {

// Verify transaction exists and is eligible

const transaction = await mcp.call('get_transaction', {

transaction_id: transactionId

});

if (transaction.status === 'completed' &&

transaction.age_days < 180) {

// Process refund

const refund = await mcp.call('create_refund', {

transaction_id: transactionId,

amount: transaction.amount,

reason: 'Customer request'

});

// Update support ticket

await updateTicket(ticketId, refund.id);

}

};

Subscription lifecycle management

Automate subscription operations through AI agents:

Automated Subscription Tasks

- Process upgrade and downgrade requests

- Handle payment failure recovery

- Manage trial conversions

- Execute retention workflows

- Generate renewal reminders

Dunning Management AI agents handle failed payments intelligently:

- Retry payments with smart scheduling

- Send personalized recovery emails

- Offer alternative payment methods

- Escalate to human agents when needed

- Track recovery success rates

Financial reconciliation automation

AI agents streamline reconciliation processes:

Daily Reconciliation Tasks

- Match PayPal transactions with internal records

- Identify discrepancies and missing transactions

- Flag suspicious patterns for review

- Generate reconciliation reports

- Update accounting systems

Monthly Financial Reporting Automated report generation includes:

- Transaction volume analysis

- Revenue by product and geography

- Refund and chargeback rates

- Payment method distribution

- Subscription metrics and MRR

Fraud detection and prevention

AI-powered fraud detection using PayPal data:

Real-time Fraud Monitoring

- Analyze transaction patterns for anomalies

- Compare against historical customer behavior

- Check velocity and geographic indicators

- Cross-reference with external fraud databases

- Flag high-risk transactions for review

Automated Response Actions

- Block suspicious transactions immediately

- Request additional verification

- Notify security team of threats

- Update fraud rules based on patterns

- Generate incident reports

Monitoring and optimizing PayPal MCP performance

Continuous monitoring ensures reliable payment processing and identifies optimization opportunities.

Key performance metrics

Track these metrics for healthy PayPal operations:

Transaction Metrics

- Success rate by payment type

- Average processing time

- Refund and chargeback rates

- Authorization vs. capture ratios

- Settlement timing

API Performance

- Response latency percentiles

- Error rates by endpoint

- Rate limit utilization

- Webhook delivery success

- Token refresh failures

Business Metrics

- Payment conversion rates

- Average transaction value

- Customer lifetime value

- Subscription retention

- Revenue per user

Setting up alerts and monitoring

Configure proactive monitoring through MintMCP's alerting system:

Critical Alerts

- Payment failures exceeding 5% threshold

- API response times over 3 seconds

- Webhook delivery failures

- Authentication errors spike

- Rate limit approaching exhaustion

Security Alerts

- Multiple failed payment attempts

- Unusual transaction amounts

- Geographic anomalies

- Velocity violations

- Access from unknown IPs

Compliance Alerts

- Missing audit log entries

- Unauthorized access attempts

- Policy violation detections

- Approval workflow bypasses

- Data retention violations

Performance optimization strategies

Improve PayPal MCP performance through:

Caching Strategies

- Cache customer payment methods

- Store subscription plan details

- Maintain product catalogs locally

- Cache exchange rates for currency conversion

Batch Processing

- Group related operations together

- Process refunds in batches

- Aggregate reporting queries

- Schedule non-critical operations

Connection Pooling

- Maintain persistent PayPal connections

- Implement connection retry logic

- Use circuit breakers for failure handling

- Monitor connection health

Troubleshooting common PayPal MCP issues

Authentication and authorization problems

Issue: OAuth Token Expiration

Symptoms: Intermittent 401 errors, authentication failures

Solutions:

- Configure automatic token refresh in MintMCP

- Implement token refresh before expiration

- Monitor token lifetime in audit logs

- Use long-lived tokens for service accounts

Issue: Insufficient Permissions

Symptoms: 403 errors on specific operations

Solutions:

- Review PayPal app permissions

- Ensure all required scopes are enabled

- Check Virtual MCP tool configuration

- Verify user has appropriate role assignments

Transaction processing failures

Issue: Payment Capture Failures

Symptoms: Authorized payments not capturing

Solutions:

- Verify capture window hasn't expired

- Check authorization amount matches capture

- Review PayPal account settings

- Monitor for duplicate capture attempts

Issue: Webhook Delivery Problems

Symptoms: Missing transaction notifications

Solutions:

- Verify webhook URL accessibility

- Check webhook signature validation

- Review webhook event subscriptions

- Implement webhook retry logic

Performance and scaling issues

Issue: Rate Limit Exceeded

Symptoms: 429 errors, throttling messages

Solutions:

- Implement request queuing and throttling

- Distribute load across multiple PayPal apps

- Cache frequently accessed data

- Upgrade to higher rate limit tier

Issue: Slow Transaction Processing

Symptoms: Timeouts, delayed responses

Solutions:

- Optimize API call patterns

- Implement asynchronous processing

- Use PayPal's batch APIs

- Review network latency issues

Frequently asked questions

What security certifications does MintMCP have for handling payment data?

MintMCP maintains SOC2 Type II certification covering security, availability, and confidentiality controls required for payment processing. The platform implements encryption at rest and in transit, access controls with multi-factor authentication, comprehensive audit logging, and regular security assessments. While MintMCP doesn't directly store payment card data (which remains with PayPal), the infrastructure meets security requirements for financial service integrations including segregation of duties and change management controls necessary for financial compliance.

Can PayPal MCP handle multiple merchant accounts and marketplaces?

Yes, PayPal MCP supports multi-merchant configurations through partner and marketplace APIs. Configure separate PayPal connectors for each merchant account in MintMCP, then combine them into Virtual MCP servers based on business requirements. This enables scenarios like marketplace platforms where AI agents process payments for multiple sellers, multi-brand businesses managing separate PayPal accounts, and partner payment distribution. The Virtual MCP architecture maintains clear separation between merchant accounts while providing unified access for authorized teams.

How does MintMCP handle PayPal webhook events for real-time updates?

MintMCP processes PayPal webhooks through secure endpoint management that validates signatures, prevents replay attacks, and maintains event ordering. Configure webhook URLs in both PayPal and MintMCP to establish bidirectional communication. The platform automatically handles webhook verification using PayPal's signature validation, retry logic for failed deliveries, deduplication of duplicate events, and event sequencing for consistency. Webhook events trigger LLM proxy rules enabling real-time responses to payment events like completed transactions, failed payments, or dispute notifications.

What happens if PayPal's API experiences downtime?

MintMCP implements resilience patterns to handle PayPal service disruptions gracefully. The platform provides automatic retry with exponential backoff, circuit breakers preventing cascade failures, fallback responses for read operations, queue management for write operations, and detailed error logging for investigation. During PayPal outages, non-critical operations queue for later processing while critical payment flows can route to backup payment providers if configured. The monitoring dashboard shows real-time PayPal API health status enabling quick response to service issues.

Can we implement custom fraud rules specific to our business using PayPal MCP?

Yes, MintMCP's LLM proxy rules enable custom fraud detection logic on top of PayPal's built-in protections. Create rules that analyze transaction patterns, velocity checks, amount thresholds, geographic restrictions, and customer history. For example, block transactions from specific countries, flag rapid-fire payment attempts, require approval for first-time high-value customers, or trigger additional verification for unusual patterns. These rules execute before PayPal API calls, preventing suspicious transactions from processing while maintaining detailed audit trails for compliance reviews.