The global AI agent market is projected to reach $52.62 billion in 2030, growing at a 46.3% CAGR. Yet traditional billing systems often struggle to handle the unique economics of AI workloads, where a single conversation can trigger hundreds of micro-activities with sub-cent costs. With 23% of organizations scaling agentic AI systems, selecting the right monetization platform directly impacts whether your AI agents generate profit or burn cash. This guide examines eight platforms that serve AI agent builders at different stages, starting with Nevermined's agent-native payment infrastructure that combines real-time metering, instant settlement, and protocol-level support for emerging standards like A2A, MCP, and x402.

Key takeaways

- Agent-native architecture matters: Purpose-built platforms like Nevermined handle agent-to-agent payments natively, while traditional billing tools require extensive custom development that can take weeks versus minutes

- Micropayment economics can determine margins: Traditional transaction fees make sub-dollar AI requests unprofitable, while agent-native platforms enable profitable transactions at any size

- Protocol support future-proofs your stack: Platforms supporting A2A, MCP, and x402 protocols reduce rebuilds as standards evolve, while legacy systems can limit you into outdated architectures

- Third-party neutral metering builds enterprise trust: Tamper-proof append-only logs enable audit-ready transparency that vendor-controlled metering systems may not match

- Implementation speed varies dramatically: Nevermined deploys in under 20 minutes, while enterprise billing platforms like Zuora require 4 to 8 weeks of professional services

1. Nevermined: The financial Rails for the agentic economy

Nevermined provides payments infrastructure specifically designed for AI agents, enabling usage-based billing, instant settlement, and agent-to-agent transactions. Founded in 2022, the platform positions itself as the financial rails for the emerging agentic economy, addressing fundamental billing challenges that traditional payment processors may not handle for AI workloads.

Introducing nevermined's core solutions

Nevermined offers two primary products that work together to solve AI agent monetization comprehensively:

Nevermined Pay delivers bank grade enterprise ready metering, compliance, and settlement so every model call turns into auditable revenue. The platform features:

- Ledger grade metering with tamper-proof append-only logs

- Dynamic pricing engine supporting multiple pricing models

- Credits based settlement with real-time tracking

- 5x faster book closing for finance teams

- Margin recovery capabilities that capture revenue previously lost to flat pricing

- Direct x402 integration as an extension to the protocol, enabling advanced agent payment capabilities

Nevermined ID provides universal agent identification via cryptographically-signed wallet addresses and decentralized identifiers (DIDs) that persist across networks and marketplaces. Key features include:

- Unique wallet plus DID per agent at registration

- Same ID maintained across environments, swarms, and marketplaces

- One lookup returns live metadata, pricing, and authorization rules

- Auto-discovery via Google's A2A protocol for instant agent connection

- Immutable IDs with unique signatures for end-to-end authenticity

How nevermined solves AI billing complexities

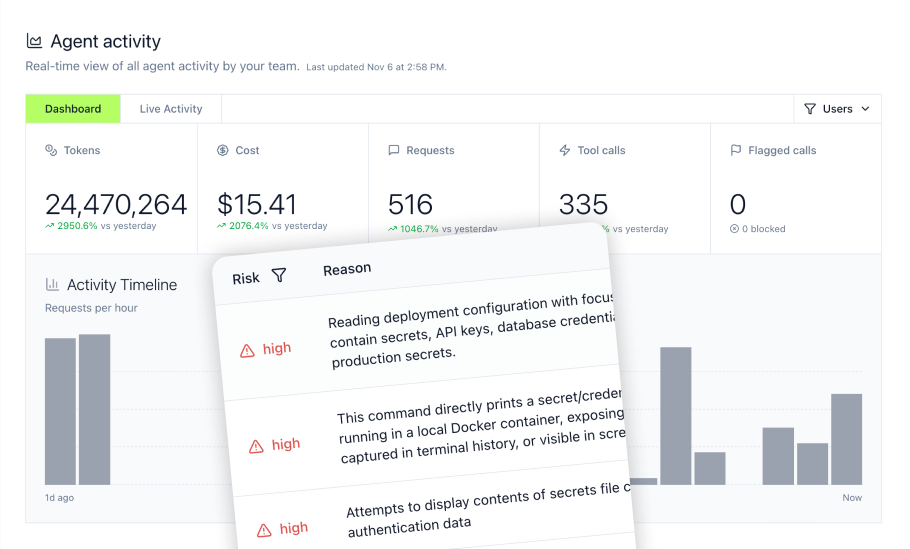

Nevermined's tamper-proof metering system creates buyer trust through independent verification. Every usage record is signed and pushed to an append-only log at creation, making it immutable. The exact pricing rule is stamped onto each agent's usage credit, allowing any developer, user, auditor, or agent to verify that usage totals match billed amounts per line-item.

This zero-trust reconciliation model satisfies enterprise procurement teams requiring audit-ready transparency. Unlike vendor-controlled metering where disputes rely on trust, Nevermined's architecture makes verification possible by any party.

Pricing models supported

The platform supports three pricing models that can be mixed and matched:

- Usage-based: per-token, per-API-call, per-GPU-cycle pricing with example rates of $0.0003 per token plus 20% margin

- Outcome-based: charging for results achieved such as completed calls or booked meetings

- Value-based: percentage of ROI or value generated

This flexibility allows AI companies to start with cost-covering baselines and layer success fees where appropriate.

Flex credits for predictable spend

Flex Credits operate as prepaid consumption-based units redeemed directly against usage. Credits solve multiple problems:

- Align price to value by charging for micro-actions and rewarding successful outcomes

- Enable flexible scaling where credits can be reallocated across users, departments, or agents without renegotiating licenses

- Provide predictable spend where users prepay credits, monitor burn rate in real-time, and avoid surprise overruns

Quick wins

Valory cut deployment time of their payments and billing infrastructure for the Olas AI agent marketplace from 6 weeks to 6 hours using Nevermined, clawing back $1000s in engineering costs.

Best For: AI builders at any stage needing agent-to-agent autonomous payments, micropayment economics, and enterprise-grade metering. Ideal for teams building on emerging protocols who want to get started free without sacrificing scale capabilities.

2. Paid.AI: AI cost tracking and margin analytics

Paid.ai focuses on helping AI developers understand and monetize their costs through detailed analytics and flexible billing models. The platform targets developers seeking visibility into LLM and API expenses with deep cost analytics capabilities.

Core capabilities

- Deep cost tracking and margin visibility across AI workflows

- Flexible billing models including per-agent, per-action, per-workflow, and outcome-based options

- Revenue operations tooling with pricing simulations

- SDK support for Node.js, Python, Go, and Ruby

- Cost tracking available free for the first year

Revenue operations focus

Paid.ai emphasizes margin visibility at the workflow level. Developers can track costs per agent and per action, then simulate different pricing strategies to understand their impact on profitability before implementation.

Platform considerations

- Focused on developer-to-customer monetization rather than agent-to-agent transactions

- Fiat-only settlement

- Vendor-controlled metering architecture

Best For: Developers prioritizing cost analytics and margin tracking for human-initiated AI interactions. Teams with established payment processors seeking usage visibility without changing their payment infrastructure.

3. Skyfire: Agent wallet abstraction

Skyfire provides agent payment capabilities through wallet abstraction, enabling developers to fund agent wallets and control spending in real-time. The platform serves growing users across its ecosystem.

Standout features

- Agent wallet abstraction with funded wallet IDs

- Real-time spend dashboards and fine-grained controls

- Under 10 minutes to implement basic functionality

- USDC primary settlement with ACH and wire options

- Partial MCP support via SDK

- Verified agent identity capabilities

Wallet-Centric architecture

Skyfire's approach centers on giving each agent a funded wallet ID that developers control. This enables real-time monitoring of agent spend and the ability to set limits before agents exhaust budgets.

Platform considerations

- Centralized architecture for identity and custody

- Partial protocol support via SDK integration

- Pricing details require direct consultation

Best For: Teams needing fast setup for basic agent wallet functionality with real-time spend controls. Organizations comfortable with centralized identity management seeking crypto-native settlement options.

4. Stripe: Traditional payments with agentic commerce extensions

Stripe processed $1.4 trillion in 2023 and remains one of the largest global payment processor. The company has introduced capabilities to address AI workloads through its Agentic Commerce Protocol.

Core strengths

- 100+ payment methods with global coverage

- Established trust and massive scale across millions of businesses

- Comprehensive third-party integration ecosystem

- New Agentic Commerce Protocol (ACP) standard for AI commerce

Webhook-Based usage billing

Stripe Billing supports usage-based pricing through webhook integration. Developers can send usage events to Stripe for aggregation into invoices, enabling metered billing for AI workloads with existing Stripe infrastructure.

Economic considerations

Transaction fees of 2.9% plus $0.30 create challenges for micropayment economics. A $0.50 transaction incurs approximately $0.315 in fees, making sub-dollar AI agent requests economically challenging.

Implementation timeline

Custom webhook development and integration typically requires 2 to 4 weeks of engineering time for AI-specific use cases.

Best For: Companies with existing Stripe infrastructure processing high-value transactions where micropayment economics are not the primary concern. Organizations seeking the trust and global coverage of an established payment processor.

5. Orb: Usage-Based billing for Developer-Led SaaS

Orb provides API-first usage-based billing used by companies like Perplexity and Vercel. The platform focuses on developer-friendly invoicing for human-initiated SaaS transactions.

Key features

- API-first design with comprehensive documentation

- Free tier up to 250 invoices per month

- $1 per invoice after the free threshold

- Proven adoption among AI companies for traditional billing needs

- Strong event ingestion capabilities

Developer-Friendly architecture

Orb emphasizes developer experience with well-documented APIs and straightforward integration patterns. The platform handles complex pricing logic on the billing side, allowing developers to focus on event emission.

Platform considerations

- Built for human-initiated SaaS transactions

- Fiat-only settlement options

- Vendor-controlled metering architecture

- 1 to 2 week implementation timeline

Best For: Developer-led SaaS companies with traditional usage-based billing needs. Teams seeking a free entry point for invoice-based billing with room to scale.

6. Alguna: No-Code billing for Non-Technical teams

Alguna, backed by Y Combinator, provides a no-code platform that enables finance and RevOps teams to manage AI billing without engineering resources. The platform claims 80% reduction in billing prep time.

Core value

- Billing efficiency through no-code configuration

- Non-technical interface for finance and RevOps teams

- Starts at $399 per month flat pricing

- Settlement via Stripe integration

- AI-native usage tracking capabilities

Finance team empowerment

Alguna's primary value proposition centers on removing engineering dependencies from billing operations. Finance teams can configure pricing, adjust plans, and manage customer billing without developer involvement.

Platform considerations

- Requires Stripe for payment processing

- 1 to 2 week implementation timeline

- Configuration-focused rather than protocol-native

Best For: Finance teams needing no-code control over billing configuration. Organizations where billing changes currently require engineering tickets and want to accelerate iteration on pricing strategies.

7. Chargebee: Traditional subscription management

Chargebee has served thousands of companies globally since 2011, focusing on subscription lifecycle management and revenue recognition for recurring revenue businesses.

Established capabilities

- Robust subscription lifecycle management

- Revenue recognition features for compliance

- Free tier available up to revenue threshold

- 0.75% billing fee after threshold

- Hybrid usage-based billing support

Subscription-First architecture

Chargebee excels at managing the complete subscription lifecycle from trial to renewal. The platform handles upgrades, downgrades, pauses, and cancellations with sophisticated dunning and retry logic.

Platform considerations

- 2 to 4 week implementation timeline typically

- Designed primarily for subscription economics

- Fiat settlement focus

Best For: Traditional SaaS companies managing subscription lifecycles with some usage-based components. Organizations prioritizing revenue recognition and subscription management over real-time AI metering.

8. Zuora with togai: Enterprise Quote-to-Cash

Zuora provides enterprise-grade quote-to-cash capabilities with Togai adding real-time metering functionality. The combined solution targets large enterprises with complex billing requirements.

Enterprise features

- Comprehensive revenue recognition meeting compliance standards

- Complex quote-to-cash workflows

- Deep compliance and audit features

- Real-time metering via Togai integration

- Multi-currency and multi-entity support

Enterprise-Scale architecture

Zuora handles the complexity of enterprise billing including contract management, revenue recognition, and financial reporting. Togai integration adds the usage metering layer that AI workloads require.

Investment requirements

- $50K to $100K+ annually for enterprise implementations

- 4 to 8 weeks implementation with professional services

- Significant internal resources required for configuration

Best For: Large enterprises with complex revenue recognition requirements, substantial budgets, and existing finance infrastructure requiring enterprise-grade compliance features.

Why nevermined stands out for AI agent monetization

Competitive edge: Agent-Native vs. Retrofitted solutions

The fundamental difference between Nevermined and traditional billing platforms lies in architecture. Nevermined was built from the ground up for autonomous AI agent commerce, while traditional platforms retrofit existing subscription and invoice infrastructure to handle AI workloads.

This architectural difference manifests in several key areas:

Protocol-Native Support

Nevermined provides native integration with emerging standards including A2A (Agent-to-Agent) protocol, MCP (Model Context Protocol), and x402. This open-protocol-first approach builds compatibility with evolving standards without requiring rebuilds as the ecosystem matures.

Third-Party Neutral Metering

While vendor-controlled metering requires trust between parties, Nevermined's tamper-proof append-only logs enable independent verification. Enterprise procurement teams can audit usage data directly rather than relying on vendor attestation.

Micropayment Economics

Traditional payment processors with percentage-plus-fixed-fee structures make sub-dollar transactions unprofitable. Nevermined's architecture enables profitable transactions at any size, capturing revenue from the hundreds of micro-activities that comprise AI agent workloads.

By implementation speed

- Under 20 minutes: Nevermined

- Under 10 minutes: Skyfire (basic functionality)

- 1 to 2 weeks: Orb, Alguna

- 2 to 4 weeks: Stripe, Chargebee

- 4 to 8 weeks: Zuora

By settlement options

- Instant crypto plus fiat: Nevermined

- Crypto primary: Skyfire

- Fiat only: Paid.ai, Stripe, Orb, Alguna, Chargebee, Zuora

Serving solo developers to enterprise platforms

Nevermined serves three primary segments with tailored capabilities:

Solo Developers and Solopreneurs: Plug-and-play API libraries, open-source components, and composable payment flows that work with any agent framework. The free tier enables experimentation without commitment.

AI Agent Startups: Low-code payments library enabling faster launch than building custom infrastructure. Valory's experience reducing deployment from 6 weeks to 6 hours demonstrates the time-to-market advantage.

Enterprise AI Platforms: Bank-grade metering, compliance features, and settlement capabilities at global scale. The tamper-proof audit trail satisfies procurement requirements while the dynamic pricing engine captures revenue across complex multi-agent deployments.

Frequently asked questions

What makes AI agent monetization different from traditional software billing?

AI agents trigger hundreds of micro-activities per interaction with sub-cent costs that traditional seat-based or subscription models may not track profitably. A single conversation might involve multiple LLM calls, API requests, and tool invocations, each requiring real-time metering and margin calculation. Agent-native platforms like Nevermined handle per-token, per-call, and per-GPU-cycle pricing with guaranteed margin built in, while traditional billing systems require extensive custom development.

How does nevermined ensure the accuracy and transparency of AI agent usage billing?

Nevermined uses tamper-proof metering where every usage record is signed and pushed to an append-only log at creation, making it immutable. The exact pricing rule is stamped onto each agent's usage credit, allowing developers, users, auditors, or agents to verify that usage totals match billed amounts per line-item. This zero-trust reconciliation model satisfies enterprise procurement teams requiring audit-ready transparency.

Can I integrate nevermined with existing AI models and frameworks?

Nevermined provides low-code SDKs in TypeScript and Python that connect with major AI frameworks in the ecosystem including OpenAI, Anthropic, LangChain, and CrewAI. The three-step integration process takes under 20 minutes: install the SDK, register payment plans with pricing rules, and validate API requests while tracking costs through the observability layer. Detailed implementation guidance is available in the developer documentation.

What pricing models are available for monetizing AI agents, and which is best for my use case?

Most successful AI agent businesses use a combination of models. Usage-based pricing covers infrastructure costs through per-token, per-API-call, or per-GPU-cycle charges. Outcome-based pricing charges for results achieved such as completed tasks or successful outcomes. Value-based pricing captures a percentage of ROI or value generated. Nevermined supports all three models and allows mixing them to avoid leaving money on the table with flat pricing.

How do flex credits benefit both AI developers and end-users?

Flex Credits solve multiple problems by enabling developers to charge for micro-actions and reward successful outcomes. For users, credits provide predictable spend through prepayment with real-time burn rate monitoring. Credits can be reallocated across users, departments, or agents without renegotiating licenses, while finance teams get trackable recurring billing instead of complex sub-cent charge reconciliation.

What is the significance of nevermined ID for the agentic economy?

As AI agents operate autonomously across networks and marketplaces, persistent identity becomes critical for payments, reputation, and authorization. Nevermined ID provides each agent with a unique wallet plus DID that maintains the same identity across environments without re-wiring. This enables agent discovery via protocols like A2A, direct linking to pricing plans, and tamper-proof event logs for audit trails and security operations.